Daily Market Commentary : Indian stocks ended flat as US tariff threat looms from Aug 1, 2025 by Mr. Siddhartha Khemka, Head - Research, Wealth Management, MOFSL

Below the Quote on Daily market commentary by Mr. Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services Ltd

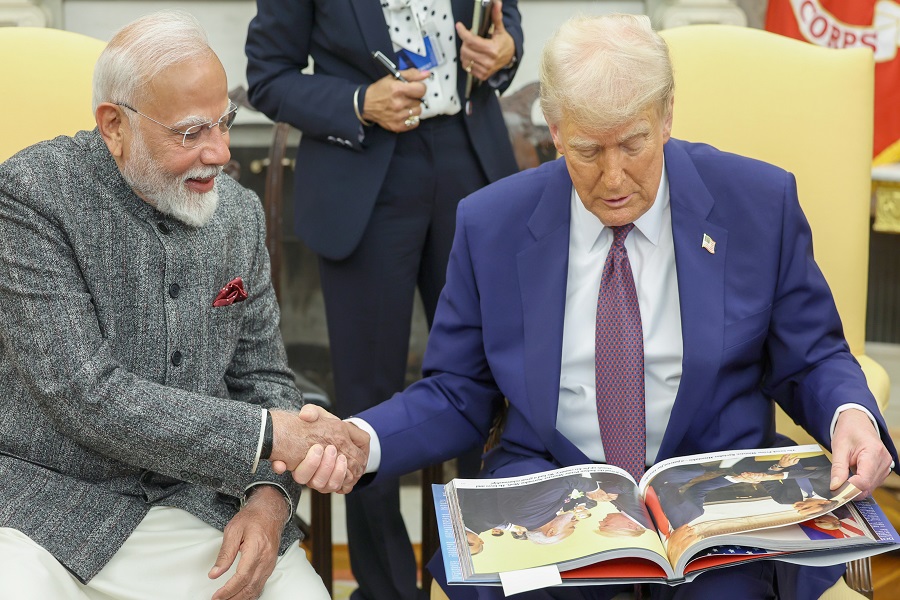

Indian equities ended flat in a lacklustre session, with investors assessing US Treasury Secretary’s comments that tariffs would be enforced starting 1st August’25 for countries yet to finalize trade deals with the US administration. Market sentiment stayed subdued on account of persistent FII selling in July (Rs5,773cr outflows over 1st to 4th July) and caution ahead of a potential mini India–US trade deal. Defence stocks witnessed profit booking, following a sustained rally in the sector. Shares of oil marketing companies and paint manufacturers advanced after crude oil prices declined, following OPEC+’s announcement of a larger-than-expected production hike for Aug’25. FMCG stocks saw fresh buying interest, supported by strong Q1 business updates from Dabur and Godrej Consumer, lifting the Nifty FMCG index by 1.6%. Within the staples segment, price hikes realized in 1QFY26, would aid overall revenue growth; while volume growth is likely to remain in the low- to-mid single digits. With the quarterly earnings season set to commence this week, stock-specific action is expected to intensify. We view Q1FY26 as a “Crossover Quarter,” marking a shift from FY25’s subdued, low single-digit earnings growth to a more sustainable double-digit trajectory over the next few quarters. We estimate 5% YoY growth in 1QFY26 Nifty earnings. A key highlight of the quarter is likely to be the improved sectoral breadth of earnings growth. Several sectors are expected to post robust double-digit PAT growth, including Capital Goods (+12%), Cement (+35%), Chemicals (+10%), EMS (+46%), Logistics (+20%), Healthcare (+11%), Real Estate (+40%), Retail (+23%), Staffing (+11%), and Utilities (+12%). Overall, while market may remain range bound in the near term amid global trade developments, improving earnings visibility and strong sectoral performance could support selective outperformance as the Q1 earnings season unfolds.

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Pre-Market Comment 11th Aug 2025 by Hardik Matalia, Research Analyst, Choice Brokin...