Daily Derivatives Report 27th November 2025 by Axis Securities Ltd

The Day That Was:

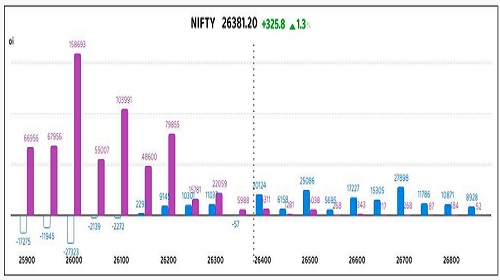

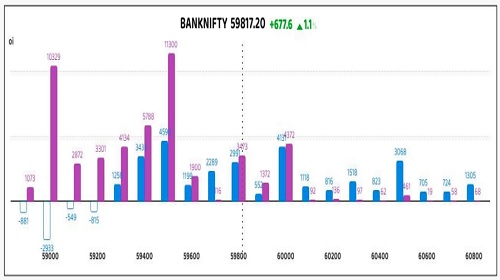

Nifty Futures: 26,381.2 (1.2%), Bank Nifty Futures: 59,817.2 (1.1%).

Nifty Futures and Bank Nifty Futures ended with major gains yesterday, opening with a significant gap-up and sustaining momentum throughout the session to break a three-day losing streak and reverse all losses to close at the highest level of the month. This price action was characterized by "buy-on-dips" strength as the indices refused to fill the opening gap, signaling strong underlying bullish sentiment supported by FII buying, upbeat global cues, and rising US Fed rate cut hopes after softer-than-expected retail sales and consumer confidence data solidified expectations for a December policy shift. Additionally, Brent crude futures dropped sharply to hover near $62 per barrel, a five-week low, following reports of potential diplomatic talks to ease the Russia-Ukraine conflict and forecasts of a global supply surplus. Reflecting this optimism, Nifty Futures rose 325.8 points with an increase in open interest of 2.6% to 149.27 lakhs, adding 3.76 lakhs shares to indicate a Long Build Up, while the premium increased to 176 from 171 points and the Put-Call Ratio (PCR) rose to 1.45 from 0.95 points. Similarly, Bank Nifty Futures rose 677.6 points with an open interest increase of 9.6% to 15.70 lakhs, adding 1.37 lakhs shares to signal a Long Build Up, although the premium decreased from 319 to 289 points as the PCR rose from 1.1 to 1.18 points. Broadening the rally, all sectoral indices traded in the green with metal, consumer durables, and media shares gaining the most, while India VIX, a gauge of market volatility expectations, tumbled 2.24% to 11.97, and the Indian Rupee remained flat with a negative bias, closing at 89.23 against the US Dollar.

Global Movers:

U.S. equity markets extended a robust four-day rally and clinching fresh highs as investors aggressively positioned themselves ahead of the Thanksgiving holiday. The Dow Jones Industrial Average surged 315 points (0.7%) to close at 47,427, while the S&P 500 and the tech-heavy Nasdaq Composite charted parallel upward trajectories, gaining 0.7% and 0.8% to settle at 6,813 and 23,215, respectively. This bullish momentum was underpinned by a combining consensus regarding monetary policy; market participants have now priced in an approximate 85% probability of a December interest rate cut. This sentiment was further hardened by a dovish chorus from Federal Reserve officials and resilient macroeconomic data. Specifically, a delayed 0.2% uptick in September retail sales, coupled with lower-than-anticipated jobless claims (216,000), painted a portrait of enduring consumer resilience despite lingering economic headwinds. Consequently, the yield on the 10-year U.S. Treasury retreated below the psychological 4.00% threshold, signaling deep market confidence in an imminent policy pivot. In the commodities complex, gold futures burnished their safe-haven appeal on the back of rate-cut optimism, climbing 1.4% to approach the $4,200 mark, while WTI Crude Oil found firmer footing, advancing 1.2% to settle near $58.65 per barrel.

Stock Futures:

PG Electroplast rebounded sharply, outpacing the broader market as rotation into Consumer Durables lifted sentiment, with the Nifty Consumer Durables index staging a strong recovery after recent declines. The stock tracked renewed buying in consumer electronics peers such as Dixon Technologies, reinforcing its long-term transition from plastic moulding to a full-fledged EMS play. Futures data signaled short covering, with prices rising 6% and open interest slipping 1.4% to 14,870 contracts, shedding 206. Options positioning showed call OI at 6,405 and put OI at 4,861, both adding 1,685 contracts, pushing PCR higher to 0.76 from 0.67. The balanced build-up in calls and puts suggests option buyers are positioning for volatility, while sellers remain cautious amid sector-wide momentum.

Siemens Ltd. rallied 4.4% after Q4 FY25 (Fiscal Year ending September 30) earnings beat expectations, with revenue up 16% YoY on strength in Smart Infrastructure and Mobility despite softness in Digital Industries. The move underscored investor conviction in its urban infrastructure and mobility-focused portfolio. Futures data reflected long additions, with open interest rising 0.7% to 21,670 contracts and a 146-contract build, while the premium to spot widened to 39.8 points from 34.5. Options activity showed call OI at 6,951 and put OI at 4,307, with additions of 3,650 and 2,653 respectively, lifting PCR to 0.62 from 0.50. The skew toward call accumulation highlights bullish bias among buyers, while put writers are pricing in sustained upside momentum.

MCX surged past the Rs 10,000 mark for the first time, propelled by record trading volumes in bullion and energy amid global commodity volatility. Optimism was reinforced by CEO Praveena Rai’s guidance of ~40% revenue growth and ~50% EBITDA expansion, alongside anticipation of the 1:5 stock split record date. Futures data showed long additions, with prices up 4.2% and open interest climbing 8.3% to 20,794 contracts, adding 1,593. The premium to spot widened to 110.5 points from 105.5. Options positioning revealed call OI at 11,645 and put OI at 9,878, with additions of 3,121 and 4,876 respectively, driving PCR to 0.85 from 0.59. The heavier put build signals hedging activity, though buyers remain constructive, while writers brace for heightened volatility around the milestone.

Bharti Airtel fell 1.4% after a supply overhang from a Rs 7,193 Cr block deal, with promoter ICIL offloading 3.43 Cr shares at Rs 2,097, a 3% discount to prior close. Futures data indicated short additions, with open interest rising 3.1% to 93,303 contracts, adding 2,814, while the premium to spot widened to 26 points from 23.3. Options positioning showed call OI at 19,288 and put OI at 14,649, with additions of 8,545 and 5,926 respectively, pulling PCR down to 0.76 from 0.81. The heavier call build reflects bearish undertones among buyers, while writers are capitalizing on supply-driven weakness to reinforce downside risk.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.45 from 0.95 points, while the Bank Nifty PCR rose from 1.1 to 1.18 points.

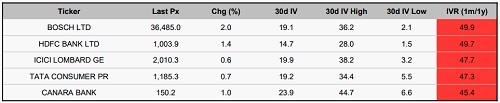

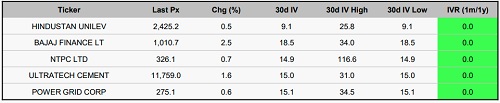

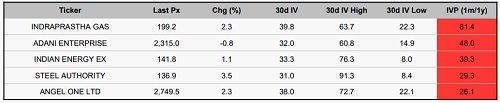

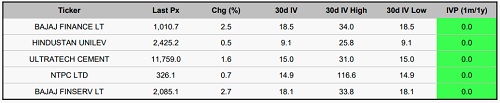

Implied Volatility:

HDFC Bank and Tata Consumer appear to be pricing in excessive risk, with Implied Volatility Ranks (IVR) reaching 50% and 48%, respectively. Since their actual realized volatilities are higher then the median at 15% and 19%, option premiums have become expensive, creating a strong case for Short Premium Strategies that benefit from time decay and mean reversion. Conversely, Bajaj Finance and HindUnilvr sit at the opposite end of the spectrum, displaying some of the lowest IVR readings in the F&O segment. With stable realized volatilities of 19% and 10%, their options are currently undervalued, making this an excellent environment for Long Premium Strategies to secure low-cost exposure.

Options volume and Open Interest highlights:

Idea and RVNL are displaying optically bullish signals with Call-to-Put ratios standing at 5:1, but the resulting surge in Implied Volatility has made their option premiums prohibitively expensive. This intense crowding in Call buying often serves as a contrarian red flag, signaling that the current rally may be approaching a near-term top. Heromotoco and Eicher Motor, conversely, are burdened by defensive market positioning. High Put volumes and significant Open Interest buildup at lower strikes suggest a bearish sentiment that is currently dragging on their price performance. TMPV and HindUnilvr show heavy accumulation of Call Open Interest at 52-week highs, while TMPC and REC Ltd are seeing similar saturation on the Put side. Traders should monitor these names for consolidation; If these stocks consolidate further, the eventual unwinding of such saturated positions could fuel a volatile, high-velocity move in either direction. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, which saw a shift of 4,165 contracts, FIIs anchored the long side by adding 3,942 contracts, effectively absorbing supply from Clients and Proprietary traders who unwound 2,820 and 1,345 contracts, respectively. This risk-on conviction intensified in stock futures; amid a turnover of 35,437 contracts, FIIs amassed a commanding 33,370 contracts, sharply contrasting with the massive liquidation of 14,529 contracts by Proprietary desks and a merely nominal addition of 2,067 contracts by Clients. The data signals a potent FII-driven bullish undercurrent, suggesting smart money is positioning for an upside breakout.

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633