|

The Day That Was:

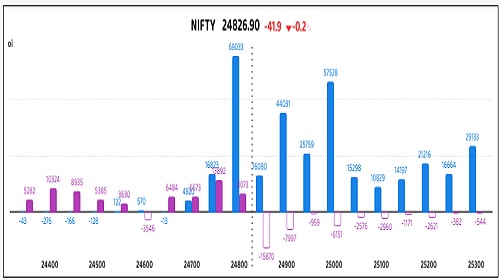

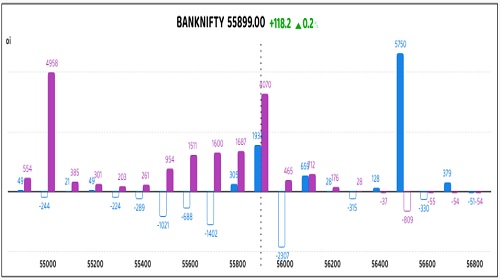

Nifty Futures: 24,826.9 (-0.2%), Bank Nifty Futures: 55,899.0 (0.2%).

Nifty futures started Wednesday's session with a subdued performance, reflecting the broader market's cautious tone, while the Bank Nifty traded within a narrow range. Geopolitical tensions, particularly between Israel and Iran, led to a sharp rise in oil prices and heightened global risk aversion, which constrained Indian indices. As the day progressed, Nifty futures saw a marginal 42-point drop, while Bank Nifty showed resilience, gaining 118 points. This was driven by escalating Middle East conflict and concerns over potential U.S. intervention, which dampened investor sentiment. Despite this, equity indices showed some resilience, reducing losses in the latter part of the day. The market's direction remains closely tied to ongoing geopolitical issues and the upcoming U.S. Federal Reserve decision, both of which will shape global risk appetite. The India VIX closed at 14.27, slightly down from 14.40, indicating a measured investor response amidst the uncertainty, without broad market capitulation. The Nifty futures premium decreased to 15 points from 16, while the Bank Nifty premium increased from 67 to 70 points.

Global Movers:

US markets ended the day without much movement, as the Fed kept rates unchanged as was expected but warned that inflation could become a problem in a few months. The S&P 500 struggled for direction, while the Nasdaq 100 was also nearly flat. Meanwhile, the Fed dots suggest two camps within the policy setting committee, where seven members expect no further cuts till year-end and the other eight expect the policy rate to be slashed by 50 bps. What's clear is that the Fed will only adjust its current policy if unemployment, inflation and growth experience material changes. Elsewhere, the Israel-Iran conflict entered its sixth day. Coming to markets, the VIX fell nearly 7% and finished above 20, the dollar index and the 10-year yield gained a little, gold declined 0.6% while brent crude gained 0.3% as President Trump said that all options were on the table when asked about whether the US will join the war.

Stock Futures:

IndusInd Bank, Avenue Supermarts, Hindustan Zinc, and Biocon Ltd. experienced sharp price movements and a significant increase in trading volumes during yesterday's market session. This surge signals a shift in sentiment, with investor confidence rising, indicating a potential change in sectoral momentum.

IndusInd Bank drew strong investor interest yesterday after Nomura upgraded the stock to a "buy" and raised its target price, implying a 25% upside. This coincided with a "Long Addition" in the derivatives segment, as the stock rose 5% and open interest increased 3.5%, with futures OI now at 85,879 contracts—up by 2,870. In options, the Put-Call Ratio (PCR) rose to 0.74 from 0.63, with call OI at 47,810 and put OI at 35,207. The market saw an addition of 8,002 call and 10,285 put contracts. While the futures data signals a bullish bias, the rising PCR and greater put additions suggest increased hedging or expectations of near-term volatility despite overall optimism.

Avenue Supermarts (DMART) hit a current-month high following the opening of a new store at Ratan Mall, Agra—its first major expansion in Uttar Pradesh after Ghaziabad. This triggered a strong "Long Addition," with the stock rising 4.2%—its biggest single-day gain in five months—and open interest climbing 4.9% to 30,915 contracts, with an addition of 1,431 contracts (2.2 Lc shares). In options, the Put-Call Ratio (PCR) rose to 0.65 from 0.45, as put OI hit a year-high of 8,857 contracts, while call OI stood at 13,569 after a reduction of 669 contracts and an addition of 2,419 puts. The data reflects bullish sentiment backed by fresh buying, but preference for put accumulation over call unwinding suggests cautious optimism, balancing momentum with downside protection.

Hindustan Zinc saw a sharp decline after promoter Vedanta sold a 1.71% stake (7.2 Cr shares) via block deals worth Rs 3,323 Cr at Rs 460.5 per share—more than a 5% discount to the previous close. This triggered a "Short Addition" in derivatives, with the stock falling 6.6% and futures open interest spiking 144.3%—the highest since its F&O inclusion—to 34,235 contracts, adding 20,220 contracts (2.5 Cr shares). In options, call OI rose by 17,815 to 38,824 contracts, while put OI increased by 6,644 to 15,452 contracts. The steep price drop, record OI jump, and heavy options buildup signal strong bearish sentiment and aggressive short positioning post-block deal.

Biocon Ltd. extended its decline for a second day following the launch of its Rs 4,500 Cr Qualified Institutions Placement (QIP) at a floor price of Rs 340.2 per share. This triggered a "Short Addition" in derivatives, with the stock falling 3.1% and futures open interest rising 31.9% to 19,945 contracts—up by 4,824 contracts (1.2 Cr shares), the highest in three series. In options, the Put-Call Ratio (PCR) stands at 0.46, with call OI at 15,310 and put OI at 7,065. A sharp contrast in additions—3,848 call contracts vs. just 263 puts—underscores strong bearish sentiment, with elevated short positioning and speculative activity anticipating further downside.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)fell to 0.8 from 0.95 points, while the Bank Nifty PCR rose from 0.74 to 0.79 points.

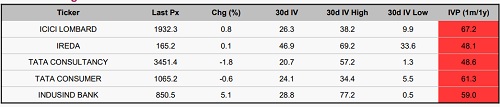

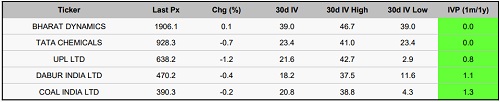

Implied Volatility:

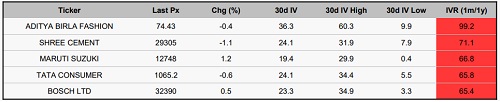

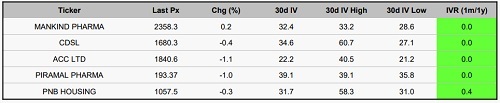

Mankind Pharma and CDSL have emerged as relatively stable performers in a volatile market, posting the lowest implied volatility (IV) rankings among their peers. With Mankind Pharma's IV at 32% and CDSL's slightly higher at 35%, both stocks exhibit consistent price behaviour, making them attractive for short-term traders seeking steadier returns amid market turbulence. In contrast, Aditya Birla Fashion and Maruti Suzuki India have experienced heightened price swings, as reflected in their elevated IV rankings of 99 and 67, respectively. Interestingly, despite a lower absolute IV of 19%, Maruti Suzuki’s higher ranking indicates a sharp deviation from its historical norm. Aditya Birla Fashion, with a current IV of 36%, has seen a spike in option premiums, further underscoring the market's pricing of future uncertainty. This elevated volatility has compelled traders to recalibrate their risk management strategies to navigate the shifting landscape.

Options volume and Open Interest highlights:

RVNL and Uno Minda are exhibiting a notably bullish sentiment, both with a call-to-put volume ratio of 5:1. This strong preference for call options indicates that investors are optimistic about potential price increases. However, this significant disparity could also suggest a risk of overvaluation in the options market, influencing traders to be cautious when entering new positions. In contrast, Granules Ltd and Dr. Reddy's Laboratories are adopting a more defensive stance, as shown by their high put-to-call volume ratios and a rise in put options activity. This trend highlights growing investor apprehensions regarding potential downside risks. The increasing put volume may hint at oversold conditions, potentially presenting contrarian opportunities for savvy traders seeking to benefit from market reversals. From a positioning perspective, Fortis Healthcare is notable for its significant open interest in both call and put options, indicating elevated volatility expectations. Similar patterns are apparent with CAMS on the call side and Bharat Dynamics on the put side, where concentrated open interest may act as significant resistance levels or trigger sudden price fluctuations. These elements set the stage for volatility-driven trading strategies, increasing the likelihood of sharp price fluctuations. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a total change of 5150 contracts was noted. Retail clients reduced their exposure by 1426 contracts, indicating caution or a bearish bias. Conversely, Foreign Institutional Investors (FIIs) increased their positions by 350 contracts, while proprietary traders added 4800 contracts, reflecting strong bullish sentiment. This suggests that retail sentiment in index futures is subdued, while institutional and proprietary desks expect upward movements or are hedging portfolios. In stock futures, a significant change of 36071 contracts occurred. Retail clients increased their long positions by 25640 contracts, indicating a bullish stance towards individual equities. In contrast, FIIs reduced their exposure by 27429 contracts, possibly indicating profit-taking or a bearish outlook. Proprietary traders added 10431 contracts, aligning with retail confidence. Overall, while retail and proprietary traders show confidence in individual stocks, institutional investors seem more cautious or defensive.

|