Daily Derivatives Report 12th November 2025 by Axis Securities Ltd

The Day That Was:

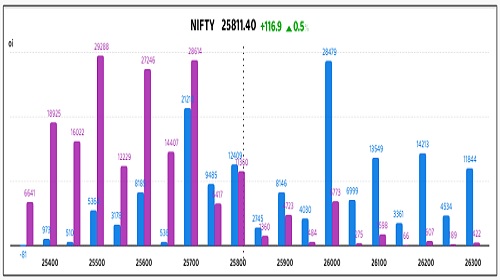

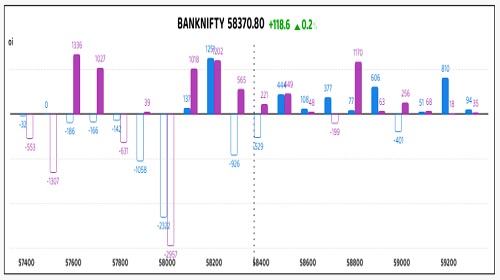

Nifty Futures: 25,811.4 (0.5%), Bank Nifty Futures: 58,370.8 (0.2%).

Nifty Futures and Bank Nifty Futures concluded a volatile session with a positive close, recovering from a weak opening amid mixed global trends and heightened caution ahead of the Nifty 50's weekly derivatives expiry. The underlying positive sentiment was primarily supported by strong gains in US stock markets (especially technology-related stocks) and easing concerns over a potential US government shutdown, which bolstered global risk appetite, along with reports of a possible upgrade of India's rating to "Overweight" by a major global firm, which offset persistent FII selling. Nifty Futures rose 116.9 points with a Long Build Up indicated by an increase of 37,700 shares in Open Interest, bringing the total Open Interest to 201.88 lakh (a 0.2% increase). Conversely, Bank Nifty Futures climbed 118.6 points with Short Covering indicated by a reduction of 8,055 shares in Open Interest, resulting in a total Open Interest of 21.43 lakh (a 0.4% decrease). The session saw a contraction in premiums, with the Nifty Futures premium decreasing to 116 points from 120, and the Bank Nifty premium shedding value from 315 points to 233 points. Capital rotation was evident, with sectors like IT, Auto, and Metals outperforming the broader indices, while Financials, Realty, and Pharma lagged behind. The India VIX, a gauge of near-term expected volatility, rose 1.54% to 12.49, indicating a minor uptick in expected market turbulence, while the Indian Rupee (INR) traded with stability against the US Dollar (USD) around the Rs 88.68 mark, awaiting the release of India's retail inflation data (CPI).

Global Movers:

The US equity market displayed a mixed performance with the Dow hitting a new record high while the tech-heavy Nasdaq Composite pulled back. This shift indicates a rotation out of high-flying technology names, which are currently facing renewed valuation concerns, and into broader blue-chip and value stocks. The Dow Jones Industrial Average surged by 1.18%, closing at a new record high of 47,927.96, driven by broad-based optimism over the looming resolution of the government shutdown and a shift toward value stocks. The broader S&P 500 also posted a slight gain, advancing 0.21% to finish at 6,846.61. In contrast, the tech-heavy Nasdaq Composite pulled back, declining by approximately 0.25% to close at 23,468.30, as investors took profits and rotated out of high-flying growth and AI-related stocks, which faced renewed valuation concerns. The 10-Year Treasury Yield was relatively steady, last observed near 4.08% on November 12, as the market continued to assess the Federal Reserve's cautious policy outlook while awaiting delayed key economic data post-shutdown. Brent Crude futures were trading slightly lower at $63.98 a barrel, falling by a marginal 0.12% from the previous session's close. Spot Gold showed significant strength, with a strong close on the previous day. International spot gold prices were trading around $4,130 per ounce, while silver has been highly volatile but finished, with a notable gain, trading internationally around $51.21 per ounce.

Stock Futures:

Bharat Forge Ltd (BHARATFORG) surged 5.9% in a single-day rally, defying a decline in standalone Q2 FY26 earnings as investors latched onto its 23% YoY jump in consolidated net profit and a promising outlook across diversified verticals. The stock witnessed short covering with futures open interest shedding 3.6%, or 734 contracts, to settle at 19,804. Options activity reflected heightened bullish sentiment, with call open interest rising by 2,672 contracts to 8,555 and put additions totaling 3,365 contracts to reach 7,518. The Put-Call Ratio (PCR) climbed to 0.88 from 0.71, while implied volatility eased 7.02% to 31.91%. The narrowing gap between call and put positioning, coupled with declining IV, suggests option buyers are pricing in stability, while writers may be bracing for directional follow-through.

Bharat Heavy Electricals Ltd (BHEL) rallied 4.3%, notching a fresh 52-week high as its Q2 FY26 results signaled a structural turnaround, with PAT tripling and robust YoY revenue growth hinting at margin recovery from legacy drag. The stock saw short covering with a marginal 0.4% drop in futures open interest, shedding 92 contracts to 23,236. In options, call open interest rose by 2,198 contracts to 15,693, while puts added 3,954 contracts to total 17,995. PCR advanced to 1.15 from 1.04, and implied volatility rose 3.53% to 33.13%. Elevated put positioning and rising IV indicate option buyers are hedging against volatility, while sellers may be positioning for range-bound consolidation.

Bajaj Finance Ltd (BAJFINANCE) tumbled 7.2%, leading the F&O laggards as cautious FY26 guidance and flat NIM projections overshadowed strong Q2 metrics, including 22–23% YoY net profit growth and 24% AUM expansion. The stock saw short addition with futures open interest rising 5.8%, adding 6,745 contracts to reach 1,23,516. Options skewed heavily toward calls, which surged by 31,419 contracts to 59,509, while puts added 6,138 contracts to 26,590. PCR dropped sharply to 0.45 from 0.73, and implied volatility contracted 13.44% to 27.38%. The aggressive call build-up amid falling PCR signals bearish sentiment from option buyers, while writers may be capitalizing on premium erosion.

Bajaj Finserv Ltd (BAJAJFINSV) declined 6.4%, echoing the negative sentiment from its lending arm Bajaj Finance, as investor concerns over cautious growth guidance rippled through the holding structure. The stock registered short addition with futures open interest climbing 6.2%, adding 4,647 contracts to 80,174. The futures premium narrowed to 17.5 points from 24.4, indicating waning bullish momentum. In options, call open interest surged by 24,018 contracts to 41,832, while puts added 7,435 contracts to 19,789. PCR slipped to 0.47 from 0.69. The disproportionate rise in call positions suggests option buyers are bracing for further downside, while sellers may be positioning for volatility compression.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.08 from 1.01 points, while the Bank Nifty PCR rose from 0.96 to 0.97 points.

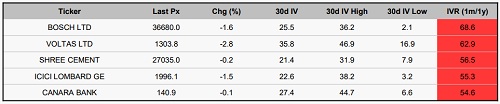

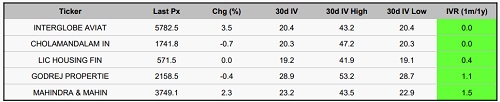

Implied Volatility:

Voltas Ltd and Bosch Ltd are trading in a heightened volatility regime, with Implied Volatility Ranks (IVRs) of 63% and 69%, respectively firmly anchoring them in the upper decile of their historical volatility curves. This surge in implied volatility has materially inflated option premiums, rendering naked directional plays such as outright calls or puts capital-inefficient and tactically misaligned with the current premium-rich environment. In stark contrast, Interglobe Aviation and Cholamandalam Investment exhibit volatility compression, each posting IVRs of just 20% the lowest across the F&O universe. This pronounced volatility trough has deflated option pricing, compressed breakeven points and enhanced leverage efficiency. Against this backdrop of subdued market expectations, long premium strategies emerge as strategically attractive, offering asymmetrical payoff potential with minimized capital.

Options volume and Open Interest highlights:

Persistent and SBI Card are currently experiencing a surge of intense bullish fervor, unambiguously signaled by their elevated Call-to-Put Volume Ratios of 5:1 and 4:1, respectively. This pronounced options-flow skew has ignited a sharp escalation in Implied Volatility (IV), consequently inflating option premiums and driving up the cost of carry for new long exposures. Historically, such an extreme call-side tilt often functions as a contrarian inflection point, subtly suggesting that the prevailing upward momentum may be cresting toward a zone of exhaustion. Shriram Finance and LTF reflect a distinct and palpable defensive undertone. This is characterized by elevated Put volumes and a significant Open Interest (OI) fortification at lower strike prices. This concentration of downside OI effectively maps a heightened demand for protective hedging, a dynamic that could exert downward pressure, pulling spot prices toward critical support thresholds. However, a stabilization of price action could see this risk-averse positioning swiftly transition into a contrarian long-entry setup. Bandhan Bank continues to display an ambivalent market posture, evidenced by the concurrent expansion in both Call OI and Put OI proximate to its 52-week highs. This symmetrical OI build is the epitome of market indecision, thereby mandating a neutral-to-cautious stance until a definitive breakout or decisive breakdown unequivocally materializes. A closer look reveals a potentially dovish interpretation for Crompton and GMR Airport, which have registered a notable surge in Call OI near their annual peaks. This pattern strongly implies Call writing (selling) rather than pure directional accumulation (buying). This points to the presence of substantial overhead supply and presages a high probability of encountering stiff technical resistance in these stratospheric price zones. Concurrently, BHEL and PFC have exhibited sustained Put OI accumulation near their yearly apex, a factor that reinforces a strong defensive bias. This persistent build-up in downside OI powerfully underscores ongoing caution regarding potential drawdowns, reflecting a broader market inclination toward protective, capital-preservation strategies. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the substantial net addition of 5,077 contracts by Retail Clients was overwhelmingly counterbalanced by the simultaneous and significant net reductions from both Foreign Institutional Investors (FIIs), shedding 3,123 contracts, and Proprietary (Prop) traders, offloading 1,983 contracts, resulting in a minimal aggregate net change of 5,106 contracts. This pattern suggests a conspicuous bearish bias or prudent hedging from the institutional and proprietary segments despite the retail optimism in the index. Conversely, in stock futures, a total change of 19,877 contracts revealed a more nuanced yet predominantly bullish collective positioning, where the robust net addition of 11,727 contracts by Retail Clients was strategically amplified by the aggressive net long accumulation of 8,150 contracts by Prop traders, easily absorbing the moderate de-risking represented by the 3,868 contract net decrease from FIIs.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

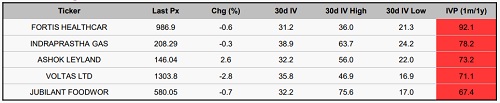

Stocks With High IVP:

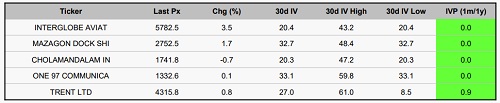

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Nifty 50 closed above 23500 and settled the month with gains of more than 6% - Religare Brok...

.jpg)