Daily Derivatives Report 04th December 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 26,213.0 (-0.5%), Bank Nifty Futures: 59,665.4 (-0.4%).

Nifty Futures closed lower, declining 76.8 points for a fourth consecutive session, while Bank Nifty Futures registered a gain, rising 71.6 points. The contrasting movements were reflected in the derivatives data: Nifty Futures saw a Short Build Up, with Open Interest (OI) increasing 4.6% by 7.19 lakh shares (total OI reached 165.09 lakhs), and its premium decreasing to 150 points from 181 points. In contrast, Bank Nifty Futures indicated a Long Build Up, with OI increasing 3.6% by 0.61 lakh shares (total OI reached 17.30 lakhs), though its premium also decreased from 392 to 389 points. This broad-based selling pressure and the decline in Nifty occurred as the Indian Rupee (USD-INR) showed sustained weakness, breaching the critical 90 mark for the first time ever to trade at a high around 90.15. The consistently weak Rupee intensified FII outflow concerns and signaled potential headwinds for the domestic economy by making imports costlier. Investor caution was further intensified by the anticipation of the Reserve Bank of India (RBI) Monetary Policy Committee (MPC) outcome on Friday, with strong domestic growth data creating uncertainty around a potential rate cut, prompting traders to reduce risk exposure particularly in rate-sensitive financial stocks. Sectorally, PSU bank, consumer durables, and auto shares tumbled, while IT, private bank, and media shares advanced, contributing to a mixed day that saw only minimal support from a mixed session in Asian markets and a slight rebound in US and European futures. Despite the selling, the India VIX indicator of near-term volatility remained stable at 11.21, suggesting the pressure was not panic-driven and institutional investors view the decline as a healthy consolidation phase.

Global Movers:

US equity markets continued their positive momentum, with all major indices closing higher yesterday. The Dow Jones Industrial Average finished strong at approximately 47,882.90, marking a gain of +0.86% (or +408.44 points), the S&P 500 Index advanced to around 6,849.72 with a +0.30% rise, and the tech-focused Nasdaq Composite closed near 23,454.09, up +0.17%. Investor confidence remains heavily influenced by expectations of eventual Federal Reserve rate cuts, especially following weaker-than-expected economic data, which supported the market rally. The yield on the benchmark 10-year U.S. Treasury note held largely steady, trading near 4.08%. This stability reflects a pause as markets digest recent economic reports ahead of the next FOMC meeting. In the commodity space, precious metals maintained their strength. Gold futures were trading firmly near $4,237 per ounce, continuing to command a safe-haven premium, while Silver saw a solid performance, trading around $59 per ounce. Both metals are being buoyed by the prospect of future monetary easing and a softening U.S. dollar. Concurrently, WTI Crude Oil was trading near $59.10 per barrel. The oil market's price action remains stabilized by the current OPEC+ production quotas alongside persistent geopolitical risks that continue to provide underlying support in the energy sector.

Stock Futures:

Biocon Ltd. advanced 2.5% defying weak market sentiment, as investors cheered news that subsidiary Biocon Biologics secured a settlement with Amgen Inc., paving the way for global rollout of Denosumab biosimilars Vevzuo and Evfraxy in oncology and bone health. Futures open interest rose 6.1% to 18,130 contracts with 1,037 additions, signaling long build-up. The Put-Call Ratio (PCR) climbed to 0.60 from 0.57, with call OI at 7,842 and put OI at 4,728, each adding over 500 contracts. The balanced rise in both sides points to aggressive call buying, while sellers face rising bullish positioning.

Hindustan Zinc Ltd. extended its rally with a 1.9% gain, supported by record-breaking silver prices that lifted expectations of margin expansion, given silver contributes 40–45% of EBIT. Futures OI fell 1.6% to 30,190 contracts with shedding of 488, indicating short covering. The futures premium widened slightly to 4.95 points from 4.8. Options activity showed call OI at 17,594 and put OI at 10,167, with additions of 1,844 and 881 respectively. The heavier call build reflects buyers positioning for continued upside, while put writers contend with strengthening bullish conviction.

Angel One Ltd. slumped 5.3%, emerging as a sector laggard after November’s business update revealed sequential declines in client acquisition (-11% MoM), daily orders (-7.7% MoM), and turnover (-10% MoM), signaling cooling retail activity. Futures OI surged 26.1% to 15,791 contracts with 3,268 additions, the largest single-day build, underscoring short additions. The futures discount widened to 88.9 points from 79.5. Options data showed call OI at 15,361 and put OI at 8,466, with sharp call additions of 7,236 versus 2,492 puts. The skew highlights aggressive bearish call writing, while buyers remain defensive amid sustained selling pressure.

Indian Bank dropped 5.2% for a second session, leading PSU banking declines after the Finance Ministry clarified no plan to raise FDI limits in PSBs beyond 20%, quashing speculation of a hike to 49%. Futures OI rose 2.6% to 12,321 contracts with 308 additions, reflecting short build-up. The futures premium widened to 7.65 points from 4.2. PCR slipped to 0.48 from 0.59, with call OI at 9,569 and put OI at 4,623, additions of 4,605 and 1,677 respectively. The sharp call build signals sellers reinforcing bearish bets, while buyers remain cautious amid fading speculative momentum.

Put-Call Ratio Snapshot:

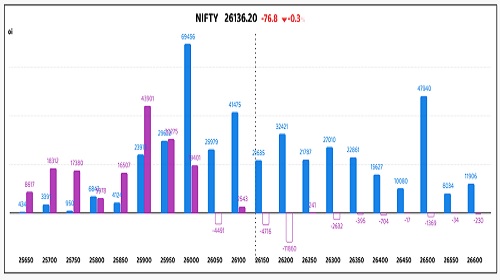

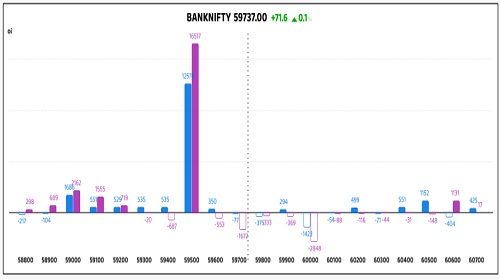

The Nifty put-call ratio (PCR) rose to 0.85 from 0.83 points, while the Bank Nifty PCR fell from 1.03 to 1. points.

Implied Volatility:

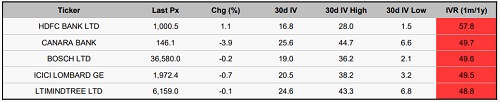

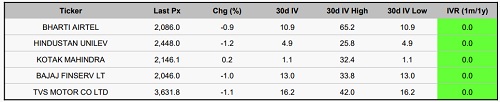

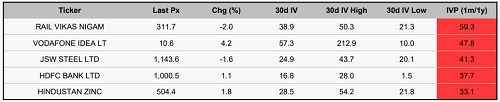

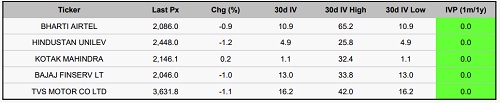

HDFC Bank and Canara Bank currently exhibit a significant options premium, which is highlighted by their high Implied Volatility Rankings (IVR) of 58% and 50%, respectively. This elevated implied volatility is notably higher than their recent realized implied volatilities, which stand at 17% for HDFC Bank and 26% for Canara Bank. The substantial difference suggests that market participants are expecting a significant future increase in volatility beyond the already high average levels. This apprehension is likely driven by concerns surrounding potential regulatory challenges and the unclear trajectory of global interest rates. In contrast, Bhartiartl and Bajaj Finserv are positioned at the bottom of the spectrum, registering the lowest IVR within the Futures and Options (F&O) segment. With current realized implied volatilities of 11% and 13%, the options for these two stocks appear to be trading at a discounted price when compared to their established historical levels. This low-volatility consensus signals an expectation of stability and limited immediate risk, a sentiment likely underpinned by robust domestic demand in the auto sector and a stabilizing operational environment within the IT sector.

Options volume and Open Interest highlights:

Dr Reddy and Tata Elxsi are exhibiting powerful short-term bullishness, as indicated by a concentrated 5:1 Call-to-Put Volume Ratio for both. This heavy leaning towards Call buying, however, suggests the existing upward price surge may be approaching its immediate high point. Conversely, Maruti Suzuki India and BSE are currently weighed down by mounting bearish expectations. This is evident from the rising volumes of Put options and a substantial Open Interest (OI) buildup at lower strike prices, which acts as a barrier to price growth. Despite this, their overall volume ratios remain neutral, hinting at a small possibility of a counter-trend reversal. For stocks potentially set for a high-velocity directional move, JSW Steel and Kaynes Ltd are in a major consolidation phase. Both stocks show a significant accumulation of Call Open Interest near their 52-week highs. Simultaneously, TMPV and Kaynes Ltd have similar saturation on the Put side. This pronounced, dual-sided concentration of Open Interest suggests that a sharp, sudden price movement is being coiled up and will be triggered by the eventual liquidation of these massed option contracts. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, the net change of 22,838 contracts was underpinned by a bullish stance from Retail Clients, who aggressively augmented their long positions by 17,180 contracts. This contrasted sharply with the actions of Foreign Institutional Investors (FIIs), who significantly reduced their exposure, offloading 13,610 contracts, indicative of a notable de-risking or bearish hedge. Meanwhile, Proprietary Traders displayed a mildly optimistic bias, accumulating 5,658 contracts. The dynamics in stock futures were even more pronounced across the 43,271 contracts net change. FIIs were the most aggressive net sellers, enacting a massive liquidation of 37,397 contracts, signaling a strong bearish conviction or sector-specific unwinding. This substantial FII divestment was largely absorbed by Proprietary Traders, whose robust long accumulation of 35,524 contracts served as a major counterbalance, suggesting either arbitrage activity or a selective speculative long play. Retail Clients also demonstrated a modest pro-cyclical preference, increasing their stock futures holdings by 7,747 contracts.

Securities in Ban for Trade Date 04-December-2025:

1. SAMMAANCAP

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

.jpg)

Stock Option OI Report 13th January 2026 by Nirmal Bang Ltd