Daily Derivatives Report 03rd December 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 26,213.0 (-0.5%), Bank Nifty Futures: 59,665.4 (-0.4%).

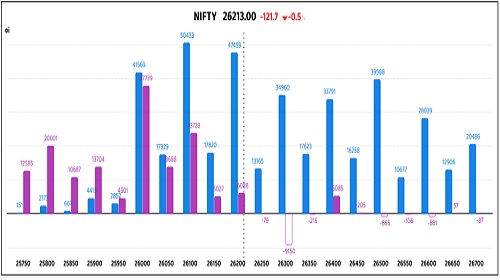

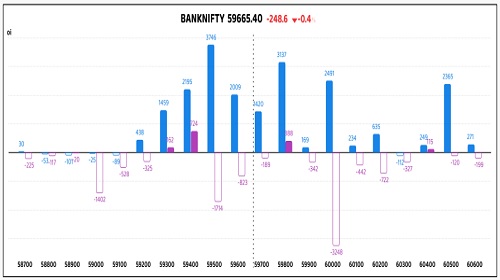

Nifty Futures and Bank Nifty futures concluded the day with substantial losses, extending their decline for the third consecutive trading session amid mixed economic signals and the Nifty weekly F&O contract expiry. The broader market displayed significant intraday volatility, first opening lower, staging a brief recovery to an intraday high, and then retracing to a low before the close, indicating sustained selling pressure throughout the day. The Nifty Bank underperformed the Nifty, with banking and financial heavyweights acting as the primary anchors for the broader market's weakness, as most sectoral indices on the NSE traded in the red, with the exception of pharma, and private bank, consumer durables, and oil & gas shares declining the most. Nifty Futures fell 121.7 points with Open Interest (OI) increasing by 6.04 lakh shares to 157.90 lakh shares, representing a 4.0% increase, signaling Short Build Up. Conversely, Bank Nifty Futures fell 248.6 points with OI decreasing by 0.22 lakh shares to 16.70 lakh shares, marking a 1.3% decrease, which suggests Long Unwinding. The premium for Nifty futures rose to 181 points from 159 points, and the Bank Nifty premium increased from 233 points to 392 points. Meanwhile, India VIX a gauge of near-term market volatility fell 3.4% to 11.23. The Indian Rupee hit a new all-time low, breaching the psychological 89.90 mark and briefly touching 90.00 intraday, with the USD-INR closing at 89.95, raising concerns over imported inflation and a widening current account deficit, which negatively impacted overall market sentiment. Investors now look ahead to upcoming IPO activity, PMI data, and the RBI’s monetary policy meeting scheduled later this week.

Global Movers:

US equity markets rebounded yesterday, with the Dow Jones Industrial Average closing higher at approximately 47,473 (0.40%), the S&P 500 Index advancing to around 6,829 (0.25%), and the tech-heavy Nasdaq Composite finishing strong near 23,414 (0.60). Investor attention remains fixed on the upcoming Federal Reserve meeting, though the underlying sentiment is still anchored by expectations of eventual rate cuts, which helped support the market rally. The yield on the benchmark 10-year U.S. Treasury note held largely steady, trading near 4.09%, reflecting a pause in the recent bond sell-off. In the metals sector, Gold futures maintained their commanding safe-haven position, trading firmly above the $4,200 threshold, near $4,229 per ounce, while Silver saw a solid rally, trading near $58.86 per ounce, both metals being buoyed by the prospect of a softening U.S. dollar and future monetary easing. Concurrently, WTI Crude Oil was trading near $58.60 per barrel, with price action stabilized by OPEC+ production quotas and persistent geopolitical tailwinds in the energy sector.

Stock Futures:

Asian Paints Ltd. (ASIANPAINT) surged to a fresh 52-week high, defying a mixed broader market after UBS upgraded the stock to ‘Neutral’ and raised its target price, citing stronger-than-expected Q2 volumes and easing competitive pressures from new entrants like Birla Opus. The stock registered a Long Addition with a 3.1% price gain and 3.7% rise in open interest, with futures OI climbing to 44,870 contracts on 1,592 new additions. Options activity showed call OI at 22,967 and put OI at 18,202, with nearly equal additions of 5,680 and 5,654 contracts respectively, signaling balanced positioning where buyers anticipate upside while writers hedge for volatility.

Samvardhana Motherson International Ltd. (MOTHERSON) extended its rally to a fresh 52-week high, outperforming the Auto Components sector as institutional accumulation drove a six-session winning streak. The stock posted a Long Addition with a 2.5% price gain and 2.6% rise in open interest, lifting futures OI to 29,647 contracts with 758 new additions. Futures traded at a premium of 1.32 points versus 1.17 earlier, reflecting stronger sentiment. Options data showed call OI at 7,781 and put OI at 5,914, with modest call additions of 22 against heavier put additions of 836, pushing PCR to 0.76 from 0.65, suggesting buyers remain constructive while sellers brace for near-term consolidation.

Hitachi Energy India Ltd. (POWERINDIA) soared to a record high, crossing the ?1-trillion market cap threshold as investors bet on its role in India’s power capex cycle spanning grid modernization, renewables, railways, and data centers. The stock logged a Long Addition with a 2.4% price gain and a sharp 14.9% rise in open interest, taking futures OI to 4,332 contracts with 561 new additions. Futures premium narrowed to 40 points from 115, indicating tempered momentum despite strong demand. Options positioning showed call OI at 2,287 and put OI at 1,261, with additions of 373 and 330 contracts respectively, reflecting steady bullish bias where buyers continue to press longs while writers cautiously absorb risk.

Indian Bank (INDIANB) slumped after NSE’s latest index rejig excluded the lender from the upcoming Nifty Bank reshuffle, triggering profit-booking and placing the stock among F&O segment’s top losers. The counter saw a Short Addition with a 3% price decline and 5.5% rise in open interest, lifting futures OI to 12,013 contracts with 626 new additions. Options activity showed call OI at 4,964 and put OI at 2,946, with heavier call additions of 1,153 versus 219 in puts, driving PCR down to 0.59 from 0.72. The skew signals option buyers bracing for further downside while writers lean on elevated call supply to cap recovery attempts.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.94 from 1.12 points, while the Bank Nifty PCR fell from 1.12 to 1.03 points.

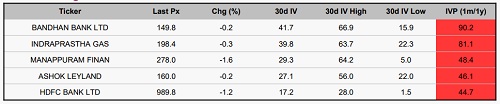

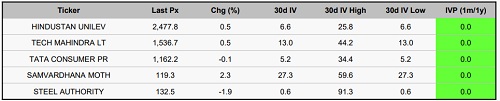

Implied Volatility:

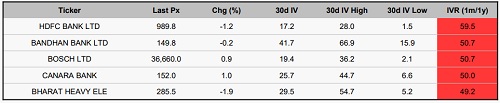

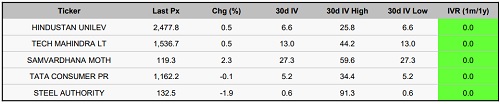

HDFC Bank and Bandhan Bank, have inflated premium as indicated by their high Implied Volatility Rankings (IVR) of 60% and 51%, respectively. This elevated implied volatility contrasts with their currently realized implied volatilities of 17% and 42%. The disparity suggests that market participants are anticipating future volatility will escalate beyond its already high median levels, a fear likely fueled by anxieties over regulatory headwinds and the uncertain path of global interest rates. Conversely, Tech Mahindra and Samvardhana Motherson are at the opposite end of the spectrum, registering the lowest IVR in the F&O segment. With current realized implied volatilities at 13% and 27%, the options for these two stocks appear under-priced relative to their historical benchmarks. This consensus reflects an expectation of stability and low immediate risk, supported by a resilient domestic auto demand and the stabilization of the IT sector's operating environment.

Options volume and Open Interest highlights:

Bharat Dynamics Limited (BDL) and Naukri Ltd are experiencing bullishness, evidenced by a 4:1 Call-to-Put Volume Ratio for both, a signal that suggests current upward momentum may be approaching a short-term peak. Conversely, Kotak Bank and MFSL reflect rising bearish concern, marked by increasing Put option volumes and significant Open Interest concentration at lower prices, which is restraining their price appreciation, though their neutral volume ratios offer a slight hint of a contrarian reversal. Looking at stocks poised for a high-velocity move, GAIL and Kaynes Ltd show a major accumulation of Call Open Interest near 52-week highs, while Kaynes Ltd and TVS Motors see similar saturation on the Put side. This heavy dual-sided concentration of OI suggests a consolidation phase before a sharp directional price spike, which will be triggered by the eventual liquidation of these massed option positions. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, total open interest saw a net increase of 19,808 contracts. This surge was predominantly driven by Retail Clients, who exhibited a strong bullish conviction by adding a substantial 17,352 contracts. Conversely, Foreign Institutional Investors (FIIs) decisively unwound a significant 12,689 contracts, indicating a clear bearish adjustment to their net positioning. Proprietary Traders added a comparatively modest 2,456 contracts, reflecting a mildly bullish skew in their highly leveraged positions. Stock futures, however, presented a divergent narrative with 92,182 contracts changing hands. Here, Retail Clients became decidedly bearish, liquidating a net 17,803 contracts. This aggressive selling was counterbalanced by the institutional heft of FIIs, who dramatically augmented their bullish exposure by accumulating 51,943 contracts. Similarly, Proprietary Traders showcased a significant risk appetite, aggressively adding 40,239 contracts.

Securities in Ban for Trade Date 03-December-2025:

1. SAMMAANCAP

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633