Daily Derivatives Report 02 July 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,643.3 (0.1%), Bank Nifty Futures: 57,689.6 (0.2%).

Nifty Futures recorded a modest 29-point gain, and Bank Nifty advanced by 136 points, reflecting a day of market consolidation and mixed performance following a robust rally. This dynamic was influenced by positive global cues and domestic profit-booking in private banks and auto stocks, instigating a sectoral rotation where PSU banks and defence stocks exhibited strength. Investor attention remained fixed on the upcoming India-US trade negotiations, whose unclear progress instilled caution, even as India's equity benchmarks closed marginally higher, bolstered by Reliance Industries and BEL. India VIX declined 2.01% to 12.53, while the rupee appreciated 25 paise to 85.51 against a weakening US dollar, which traded at its lowest since Feb’22. Nifty futures premium expanded to 102 from 97 points, while Bank Nifty premium contracted to 230 from 241 points.

Global Movers:

US stocks had a mixed outing as investors weighed Fed Chair Powell's latest comments. The S&P ended 0.1% down while the Nasdaq fell 0.8%. It was the tech index's first drop in seven days and came as heavyweights such as Nvidia and Tesla fell, with the latter dropping over 5% as the relationship between the President and Elon Musk soured further. Chair Powell, in the meantime, said that the Fed would have reduced rates further had the Oval office not announced tariffs. Elsewhere, manufacturing data showed a diverging picture as ISM contracted for the fourth straight month while the S&P equivalent showed an expansion. In other news, President Trump's $3.3T tax bill passed the senate test narrowly, and will face its final test on Wednesday. Coming to related markets, the VIX was largely flat, the dollar index fell for the 8th day in nine, the 10-yr treasury yield barely budged at 4.2%, gold rose for a second day as the "big, beautiful bill" raised concerns of a deficit increase and oil prices steadied near $67 after Iran cut off communication with UN officials.

Stock Futures:

Yesterday's trading session saw a discernible shift in investor focus across key sectors, as evidenced by significant changes in trading volume and price volatility for IDFC First Bank, RBL Bank, NMDC Ltd, and PG Electroplast. This heightened activity suggests either a rotation of capital into or out of these specific sectors or a re-evaluation of their intrinsic values by market participants.

IDFC First Bank has experienced a robust upsurge, marking its third consecutive day of gains, primarily propelled by a significant upgrade from brokerage firm Investec. The firm elevated its rating to "Buy" and raised the target price, projecting a 29% CAGR in the bank's core pre-provisioning operating profit (PPoP) from FY25-28 and an enhancement in RoA to 1.3% by FY28, attributed to anticipated reductions in cost-to-assets and credit costs. IDFCFIRSTB has witnessed a Long Addition with a price appreciation of 5.7% and an increase in open interest of 1.2%. The current futures open interest stands at 43,799 contracts, reflecting a new addition of 532 contracts. The futures closed at a premium to the spot price of 0.23 points, a decrease of 0.24 points compared to the previous session's premium of 0.47. In option positioning, the total open interest in call options is at 9,676 contracts, while put options stand at 8,014 contracts, bringing the put-call ratio to 0.83. This dynamic in the derivatives market suggests a mildly bullish sentiment with call writers exhibiting greater conviction than put writers, potentially anticipating limited upside momentum in the immediate term.

RBL Bank has experienced a significant advancement in its stock price, primarily fueled by a recent positive outlook from Citi Research. This prominent brokerage has integrated RBL Bank into its 90-day Catalyst Watch list and revised its target price upward, underscoring a positive reassessment of the bank's near-term potential. This positive sentiment precipitated a Short Covering in RBL Bank, evident from a 4.5% price appreciation coupled with a 7.6% reduction in open interest. The current futures open interest stands at 28,175 contracts, marking a shedding of 2,320 contracts, which translates to 73.7 Lc shares in open interest, further validating the short covering activity. In the options segment, the total open interest in call options is 5,054 contracts, while put options total 3,560 contracts. Notably, there has been a decrease of 1,529 contracts in call options and a reduction of 535 contracts in put options. This derivative activity indicates a diminishment in both call and put writing, suggesting that option sellers, particularly call writers, are unwinding their positions, which could signal an expectation of further upward price movement. The decline in open interest across both call and put options, with a more pronounced reduction in calls, implies a lessening of aggressive selling pressure from option writers, potentially paving the way for the stock's continued ascent.

NMDC Ltd. has confronted a discernible downtrend in its stock price, primarily influenced by a recent corporate decision to implement a reduction of over 9% in iron ore prices. This strategic adjustment is likely attributable to prevailing pricing pressures and a bearish outlook for the broader iron ore market. In the derivatives segment, NMDC has experienced a Short Addition, marked by a 2.7% price depreciation and a significant 8.7% surge in open interest. The current futures open interest stands at 19,903 contracts, reflecting a substantial influx of 1,584 new contracts, the highest single-day addition in the last three series, which equates to 2.14 Cr shares in open interest. This connected increase in price decline and open interest signals a strong bearish sentiment and a build-up of short positions by market participants anticipating further price erosion. In option positioning, the total open interest in call options is 8,265 contracts, and in put options, it is 5,976 contracts. The addition of 1,440 contracts in call options and 810 contracts in put options indicates heightened activity from both call and put writers. However, the more pronounced addition in call options, alongside the price decline, implies that call writers are aggressively establishing positions, betting against any potential upward movement, while put writers are also fortifying their downside hedges or speculating on continued weakness. The collective derivative data underscores a pervasive bearish conviction, with market participants actively positioning for further downside in NMDC.

PG Electroplast, a new entrant in the F&O segment for the current series, has commenced its trading journey with a downward movement, concluding below the previous month's lows, despite otherwise favourable developments. This decline was accompanied by notable volumes, even in the face of a recent block deal where the Government of Singapore acquired a significant stake, and the company's active participation in various investor meets highlighted its growth potential. The immediate market reaction, therefore, reflects a broader cautious sentiment currently prevailing in the Consumer Durables - Electronics sector, which has encountered recent challenges, overshadowing PG Electroplast's strong fundamentals and positive growth projections. In the derivatives market, PGEL has witnessed a Short Addition, evidenced by a 4.2% price decrease and a substantial 46.9% expansion in open interest. The current futures open interest stands at 3,653 contracts, with a new addition of 1,167 contracts, equating to 8.2 Lc shares in open interest. This confluence of price decline and a significant surge in open interest underscores a bearish conviction, indicating that participants are actively establishing short positions, anticipating further downside in the stock. The derivative data signals that market participants are leveraging the F&O segment to express their bearish outlook, positioning for continued weakness in PG Electroplast.

Put-Call Ratio Snapshot:

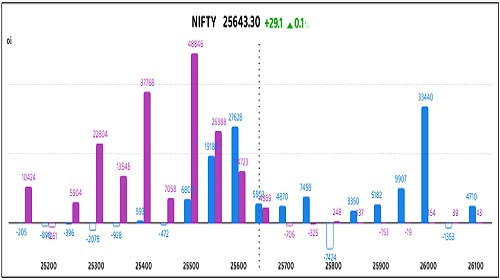

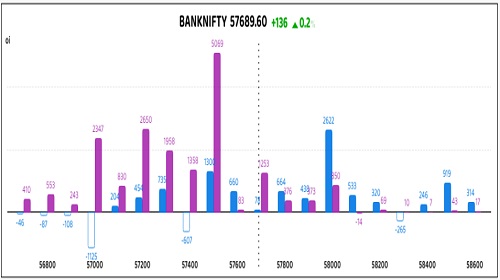

The Nifty put-call ratio (PCR) rose to 0.88 from 0.81 points, while the Bank Nifty PCR rose from 1.08 to 1.15 points.

Implied Volatility:

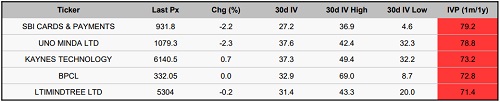

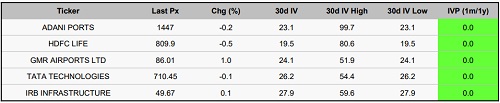

SBI Cards and Maruti are currently experiencing significant stock price fluctuations, as evidenced by their elevated implied volatility (IV) levels of 70 and 67, respectively. Presently, the IV for SBI Cards stands at 27%, while Maruti's IV is slightly lower at 20%. The increase in implied volatility has led to higher option premiums, prompting traders to recalibrate their risk management strategies accordingly. In contrast, Adani Ports and HDFC Life exhibit more stability, with the lowest IV scores in their sector—23% for Adani Ports and 20% for HDFC Life. This lower volatility, combined with their consistent price behaviour, positions these stocks as attractive options for investors seeking to maintain long positions amidst heightened market uncertainty and volatility.

Options volume and Open Interest highlights:

Titagarh Rail and Tata Communications are demonstrating robust bullish sentiment, with call-to-put ratios of 6:1 each, signaling strong trader optimism regarding short-term price appreciation. However, such elevated ratios could imply potential overvaluation in the options market, necessitating caution when initiating fresh long positions. In contrast, Tata Power and Nestle India are exhibiting more defensive market signals, reflected by higher put-to-call ratios and a notable increase in put volumes, suggesting heightened concerns among investors about potential downside risks. While this indicates a bearish bias, the surge in put activity could also point to oversold conditions, offering potential contrarian opportunities for traders forecasting a reversal in trend. Regarding open interest positioning, new F&O entrant, Amber Enterprises has a substantial concentration in call options, followed closely by Kaynes Technology, signaling strong expectations of upward price movement. Conversely, Jio Financial and Apollo Hospitals hold significant open interest on the put side, highlighting market expectations of price retracements that could establish critical support or resistance levels. These dynamics suggest the potential for heightened market volatility, making strategies that capitalize on price swings. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a total shift of 4954 contracts was observed. A notable bearish sentiment among clients led to a substantial decrease of 4045 contracts, while Foreign Institutional Investors (FIIs) also exhibited a negative outlook, decreasing their positions by 583 contracts. In stark contrast, proprietary traders demonstrated a significant bullish conviction, adding a mirroring 4954 contracts, fully absorbing the net decrease from clients and FIIs. This divergence suggests a market where proprietary desks are actively counterbalancing the broad-based negative sentiment from both retail and institutional foreign participants in index futures. Turning to stock futures, the market witnessed a total change of 41035 contracts. Here, clients displayed a strong bullish bias, significantly increasing their positions by 41035 contracts. Conversely, FIIs demonstrated a considerable bearish stance, reducing their holdings by 21470 contracts, indicating a cautious or profit-taking approach. Proprietary traders also contributed to the negative sentiment, decreasing their positions by 2527 contracts. This configuration in stock futures points to retail investors as the primary drivers of positive momentum, while both FIIs and proprietary traders are either hedging or anticipating a downside, creating a clear association in market sentiment across different participant categories.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633