Daily Derivative Report - 14th November 2025 by Religare Broking Ltd

Market Outlook

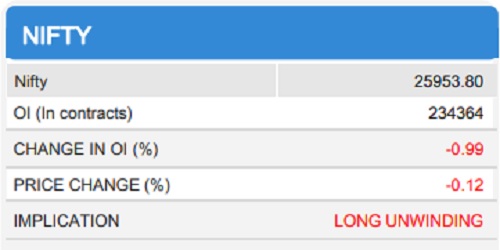

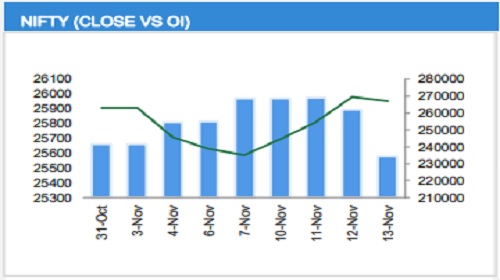

The Nifty 50 closed at 25,879, witnessing a muted session. On the daily chart, the index faced selling pressure near the key hurdle of 26,000 and ended the day flat. In the derivatives segment, fresh Call OI build-up was observed at the 26,000 strike, marking it as a crucial level to watch for any further upside potential. On the downside, some covering was seen in ATM Put options, while significant Put OI build-up emerged at the 25,500 strike, indicating that a sustained move below the 26,000 level could trigger a corrective decline towards 25,500 in the coming sessions.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330