Credit Offtake Moderates ~250 bps After Reporting-Date Adjustments by CareEdge Ratings

Synopsis

* After adjusting for reporting date to ensure a year-on-year (y-o-y) comparison, bank credit and deposit growth appear steady rather than accelerated, indicating that the underlying momentum remains broadly stable. Meanwhile, on an unadjusted basis, credit and deposit growth have continued their upward trajectory, with the current fortnight recording the strongest expansion since June 2024 (highest in the past 19 months). The credit–deposit growth gap stood at 186 bps in the current fortnight, lower compared to the previous fortnight.

* As of December 31, 2025, total bank credit breached the Rs 200 lakh crore mark and reached Rs 203.2 lakh crore, up 14.5% y-o-y. This increase was higher than the 11.2% growth recorded in the same period last year, accentuated by a change in the definition of a reporting fortnight under the Banking Laws, where the reference date shifted from December 27, 2024, to December 31, 2025, thereby capturing the typical quarter-end credit drawdown over the additional four-day period. If we adjust for the impact of these additional four days, bank credit growth would have stood at 11.7-12%1, which is consistent with the growth observed in earlier periods. This growth was supported by the impact of GST rate cuts, sustained activity in the retail (auto loans) and MSME segments, a revival in lending to non-banking financial corporations (NBFCs), and opportunistic corporate borrowings.

* Bank deposits too rose 12.7% y-o-y to Rs 248.6 lakh crore, higher than the 9.8% growth observed a year earlier, year attributed by a change in the definition of a reporting fortnight under the Banking Laws where the reference date shifted from December 27, 2024, to December 31, 2025 thereby capturing the typical quarter-end credit drawdown over the additional four-day period. Meanwhile, if we exclude this four-day impact, bank deposits would grow by 10.8-11.5%1. Additionally, an increase in deposit growth could be attributable to a favourable base and aggressive deposit mobilisation efforts by banks. Meanwhile, deposit growth continues to lag credit offtake due to intense competition and savers shifting to alternative avenues.

* As of December 26, 2026, the WACR was down to 5.43%, remaining flat as compared to the previous fortnight, remaining 18 basis points (bps) above the current repo rate of 5.25%, reflecting tight liquidity in the system.

Bank Credit Offtake Witnesses an Uptick for the Fortnight

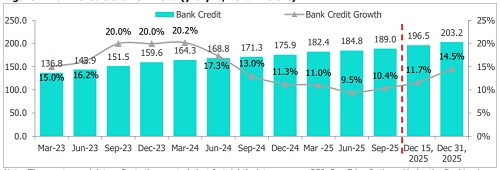

Figure 1: Bank Credit Growth Trend (y-o-y%, Rs lakh crore)

Bank credit exhibited a strong momentum, registering a y-o-y growth of 14.5% as of the fortnight ended December 31, 2025, higher as compared to 11.2% a year earlier, along with a 3.4% sequential increase over the previous fortnight. In absolute terms, credit expanded by Rs 25.8 lakh crore over the last year, reaching Rs 203.2 lakh crore. This increase was accentuated by a change in the definition of a reporting fortnight under the Banking Laws, where the reference date shifted from December 27, 2024, to December 31, 2025, thereby capturing the typical quarter-end credit offtake over the additional four-day period. If we exclude this four-day impact, total bank credit would grow by 11.7-12%. The growth was supported by the impact of GST rate cuts, sustained activity in the retail (auto loans) and MSME segments, and a revival in lending to NBFCs. Additionally, early signs of a resurgence in industrial credit and opportunistic corporate borrowing have supported this growth.

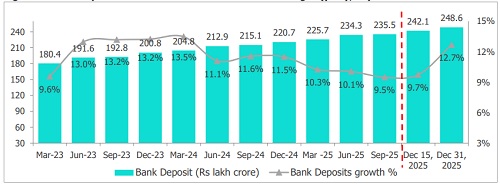

Figure 2: Bank Deposit Growth Rate Increases for the Fortnight (y-o-y, %)

As of December 31, 2025, aggregate bank deposits stood at Rs 248.6 lakh crore, registering a y-o-y growth of 12.7%, increasing over the previous fortnight, attributed by a change in the definition of a reporting fortnight under the Banking Laws where the reference date shifted from December 27, 2024, to December 31, 2025 thereby capturing the typical quarter-end credit drawdown over the additional four-day period. Meanwhile, if we exclude this four-day impact, bank deposits would grow by 10.8-11.5%1. Additionally, an increase in deposit growth could be attributable to a favourable base and aggressive deposit mobilisation efforts by banks. During the latest fortnight, time deposits, which account for 87.9% of total deposits, rose 10.7% y-o-y to Rs 215.8 lakh crore, up from 10.4% in the year-ago period. While demand deposits rose significantly by 27.4% y-o-y, compared with 5.7% a year earlier.

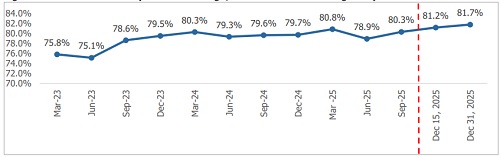

Figure 3: CD Ratio Inches up to All Time High, Nears 82% - incl. merger impact.

As of the fortnight ended December 31, 2025, deposit inflows stood at Rs 6.5 lakh crore, while credit outflows were marginally higher at Rs 6.7 lakh crore, indicating that credit demand slightly outpaced deposit mobilisation during the period, keeping the CD ratio at an all-time elevated level of 81.7%.

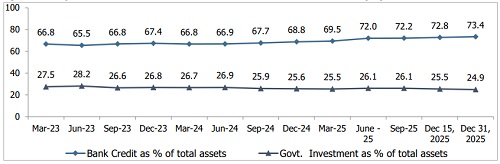

Bank Credit Share Sees a Strong Uptick while Government Investments Decrease

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

In the fortnight ended December 31, 2025, the bank credit-to-total-assets ratio edged up by 60 bps 73.4%, while the government investment-to-total-assets ratio decreased at 24.9%, attributed to strong loan growth outpacing expansion in other asset classes. Total government investments stood at Rs 68.8 lakh crore, registering a 4.4% yo-y increase, while remaining flat sequentially. Meanwhile, money at call and on short notice increased sequentially, indicating a liquidity surplus in the system.

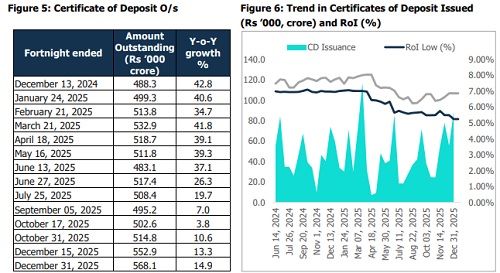

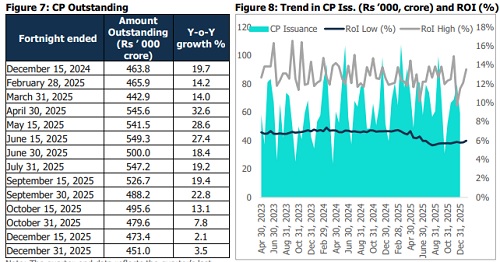

Issuances of Certificates of Deposits (CDs) and Commercial Papers (CPs) on the Rise

For the fortnight ended December 31, 2025, outstanding CD issuances rose by 14.9% y-o-y, indicating a renewed pickup after the sharp moderation observed through September–October 2025, likely reflecting credit growth and tighter liquidity conditions.

.

Above views are of the author and not of the website kindly read disclaimer