Credit and Deposit Growth Ease Sequentially; CD Ratio Remains Above 80% by CareEdge Ratings

Synopsis

* On a year-on-year (y-o-y) basis, both bank credit offtake and deposit growth continued to expand; however, sequentially, both recorded a mild contraction.

* As of November 14, 2025, total credit off-take rose to Rs 193.5 lakh crore, up 11.4% y-o-y. GST rate cuts, sustained retail and MSME activity, and some corporate borrowing amid rising bond yields all contributed to the increase. Meanwhile, this growth was slightly lower than the 11.6% growth in the same period last year due to reduced lending to certain segments.

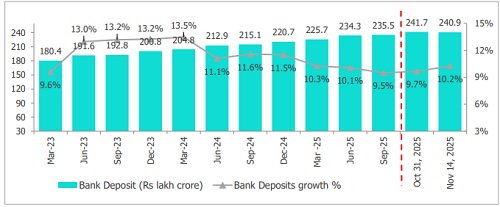

* Bank deposits rose 10.2% y-o-y to Rs 240.9 lakh crore, moderating from the 11.5% growth seen a year earlier (ex-merger). The moderation in growth is partly due to the ongoing rate-cut cycle, which has increased the attractiveness of alternative investments over conventional bank deposits.

* As of November 14, 2025, the weighted average call rate (WACR) eased to 5.37%, compared with 5.41% in the previous fortnight, and remained 13 bps below the repo rate of 5.50%.

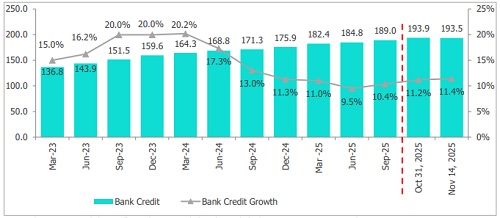

Overall Bank Credit Growth Continues, Albeit at a Softer Pace

* Bank credit off-take registered a y-o-y growth of 11.4% as of the fortnight ending November 14, 2025, compared to 11.6% excluding merger impact, while recording a 0.4% sequential decline over the previous fortnight. In absolute terms, credit expanded by Rs 15.4 lakh crore during the past ten months, reaching Rs 193.5 lakh crore. Overall growth was driven by recent GST rate reductions, steady traction in retail and MSME segments, and an uptick in corporate borrowing amid elevated bond yields.

Figure 2: Bank Deposit Growth Rate Increases for the Fortnight (y-o-y, %)

* As of November 14, 2025, aggregate bank deposits stood at Rs 240.9 lakh crore, reflecting a 10.2% y-o-y increase, though marginally declining by 0.3% over the previous fortnight. Deposit growth continued to lag the 11.5% (ex-merger) expansion recorded in the corresponding period last year, largely due to a shift of funds towards higher-yielding alternative investment avenues. The latest fortnightly movement was influenced by seasonal factors, with demand deposits rising 19.0% y-o-y, significantly higher than the 8.9% growth seen a year earlier, supported by a favourable base and stronger festive-season inflows. Meanwhile, time deposits, which constitute 87.6% of the total deposit base, grew by 9.1% y-o-y to Rs 211 lakh crore, moderating from 11.5% in the same period last year

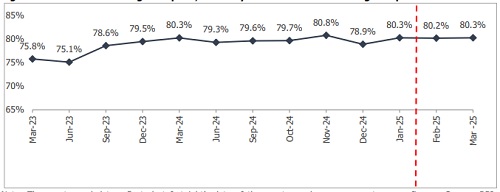

Figure 3: CD Ratio Saw Marginal Uptick, And Stays Above 80% - incl. merger impact

The credit-to-deposit (CD) ratio increased marginally to 80.3% in the fortnight ending November 14, 2025, though it continued to stay above the 80% mark.

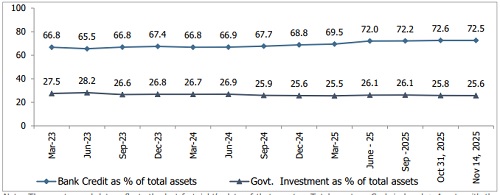

Bank Credit Share and Government Investments See a Marginal Dip

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

The bank credit-to-total-assets ratio and the government investment-to-total-assets ratio eased slightly by one and two bps to 72.5% and 25.6% in the fortnight ending November 14, 2025. Total government investments stood at Rs 68.3 lakh crore, reflecting a 5.3% y-o-y increase and a modest sequential decline of 0.8%. Meanwhile, balances with other banks and money at call and short notice rose sequentially, reflecting the banking system's surplus liquidity, which averaged around Rs 2.87 lakh crore during the fortnight.

Above views are of the author and not of the website kindly read disclaimer