Cooling Credit Offtake Continues to Outperform Deposit Growth by CareEdge Ratings

Synopsis

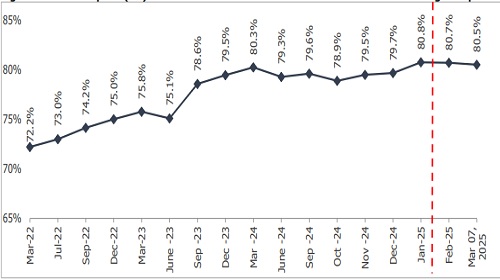

• Credit offtake picked up marginally, while deposit growth slowed over the previous fortnight. Furthermore, the gap between credit and deposit growth has slightly widened from 0.71% in the last fortnight to 0.88% in the current fortnight, compared to the same period the previous year, when the gap stood significantly higher at 6.70%.

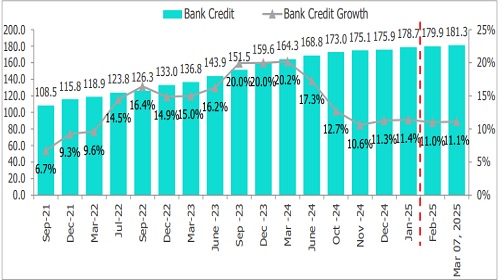

* As of March 07, 2025, credit offtake reached Rs 181.3 lakh crore, marking an 11.1% year-on-year (yo-y) increase, slower than last year’s rate of 12.1% (excluding merger impact). This slowdown can be attributed to a higher base effect, alongside measures implemented by RBI, as well as market concerns regarding elevated credit-to-deposit ratio.

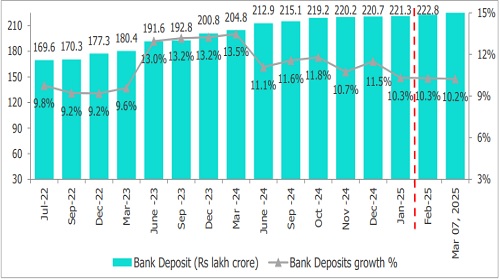

* Deposits rose 10.2% y-o-y, totalling Rs 225.1 lakh crore as of March 07, 2025, a decrease from 10.5% the previous year (excluding merger impact). This slower growth is primarily attributed to a higher base effect and tightened liquidity conditions despite elevated term deposit rates offered by Scheduled Commercial Banks (SCBs).

• The Short-term Weighted Average Call Rate (WACR) has decreased to 6.25% as of March 07, 2025, down from 6.52% on March 15, 2024.

Bank Credit Growth Rate Witness a Marginal Uptick for the Fortnight Figure 1: Bank Credit Growth Trend (y-o-y %, Rs. Lakh crore)

Figure 2: Bank Deposit Growth Witness a Marginal Downtick for the Fortnight (y-o-y %)

Figure 3: Credit-Deposit (CD) Ratio Reduces a Tad Yet Remains Above 80% – Incl. Merger Impact

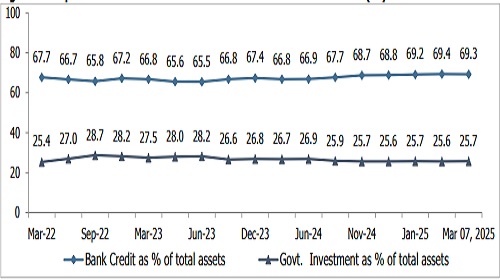

The Proportion of Bank Credit marginally, and Govt. Invest. to Total Assets witness an uptick Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

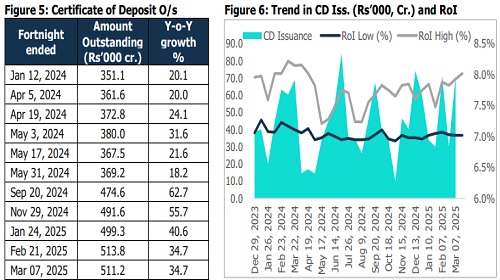

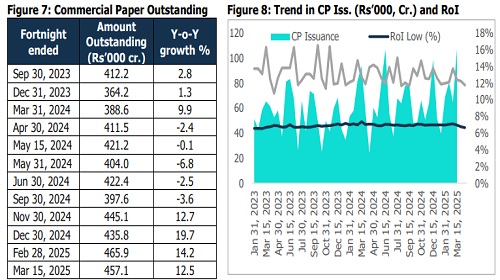

O/s CDs are at all-time high levels, and CPs Continue to Remain at Elevated Levels with Tight Liquidity Conditions and High Short-term CD and CP Rates

Above views are of the author and not of the website kindly read disclaimer