Company Update : Union Bank of India Ltd By Motilal Oswal Financial Services Ltd

Controlled provisions and robust other income drive earnings beat; asset quality improves

* Union Bank of India (UNBK) reported a 3QFY25 PAT of INR46b (+28.2% YoY, 27% beat) led by lower provisions and higher-than-expected other income.

* NII grew 0.8% YoY to INR92.4b (up 2.1% QoQ; in line). NIMs expanded slightly by 1bp QoQ to 2.91% during the quarter.

* Other income grew 17% YoY to INR44.2b (6% higher than MOFSLe). Total income, thus, grew 5.5% YoY to INR136.6b (in line). As a result, the overall C/I ratio increased 158bp QoQ to 45.1%.

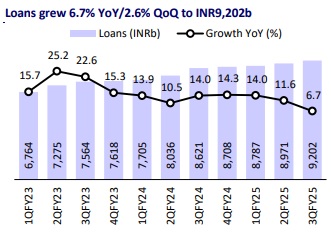

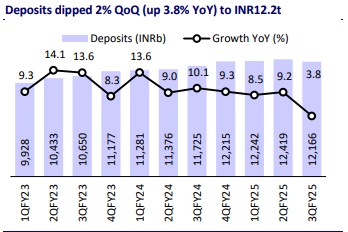

* Business growth was modest, with advances growing at 6.7% YoY/2.6% QoQ to INR9.2t. Retail books grew 16.4% YoY (4.9% QoQ) and commercial books grew 4.3% YoY (1.9% QoQ). Deposits grew 3.8% YoY/declined 2% QoQ; CD ratio thus increased to 75.6%. CASA ratio improved 71bp QoQ to 33.4%.

* Fresh slippages improved to INR19.7b from INR52.2b in 2Q, down 27% YoY/62% QoQ. GNPA/NNPA ratios improved 51bp/16bp QoQ to 3.85%/ 0.82%. PCR ratio increased to 79.3%

Valuation and view:

UNBK reported a steady quarter wherein the bank witnessed lower provisions and healthy other income leading to an earnings beat. NIMs remained broadly flat at 2.91%. Business growth was modest, with loans and deposits both growing slower than expected; however, the CASA ratio exhibited an improvement. On the asset quality front, slippages improved with the GNPA/NNPA ratio showing a 51bp/16bp QoQ improvement. The earnings call is scheduled for 28th Jan’25 at 12.00 pm IST.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412