CareEdge Ratings sees long-term energy demand growth at around 6% driven by GDP growth and other enablers like EVs, Data Centers, Green Hydrogen

According to CareEdge Ratings, the long-term energy demand is projected to rise by around 6% p.a till 2030, aided by sustained economic expansion and emerging demand drivers such as electric vehicles, data centers, and green hydrogen.

India’s power sector has witnessed strong demand momentum, with growth between 7.7% and 9.4% during FY22–FY24, supported by a healthy rebound in GDP post-Covid. The Government of India has targeted 100 GW of new thermal capacity by FY32, with ~33.2 GW currently under construction. CareEdge Ratings believes that further capacity addition is expected to accelerate with the commissioning of under-construction projects and placement of fresh orders.

According to CareEdge Ratings, the power sector is undergoing a significant transformation, with renewable energy poised to drive future capacity additions. CareEdge Ratings believes that while thermal capacity additions will remain critical to support base load requirements until renewable energy with storage solutions scales up, the generation mix is set to evolve rapidly. The share of non-fossil sources in total energy generation is expected to rise to over 35% by FY30, compared to 25% in FY25, with new capacity additions led by solar, followed by wind. Also. a positive point to note is that domestic coal supply has grown at a 9% CAGR over the last five years, reducing reliance on imports and mitigating fuel cost and forex risks.

Sabyasachi Majumdar, Senior Director, CareEdge Ratings said, “India’s power sector is at an inflection point—renewable energy and storage will drive future capacity growth, even as the thermal segment provides critical stability to meet rising demand. With reforms strengthening discom finances, coal supply ensuring fuel security, and storage costs rapidly declining, the sector is positioned for sustainable, reliable, and green growth in the coming decade.”

Thermal power, however, continues to play a critical role in meeting India’s base-load requirements. Plant Load Factors (PLFs) have improved from 56% in FY20 to 70% in FY25, backed by robust power demand and healthy domestic coal supply. Nearly 33 GW of thermal capacity is currently under construction, with private players expected to contribute about one-third of future additions.

CarEdge Ratings notes that the Aggregate Technical and Commercial (AT&C) losses have declined to 15–16% in FY22–24, compared to ~22% during FY19–21.

Renewable Energy and Domestic Manufacturing to Gain Pace

CareEdge Ratings believes that Renewable energy is set to accelerate with growing tariff competitiveness and strong policy support. Solar and wind remain cost-effective, with solar projects featuring 4-hour storage discovering tariffs as low as Rs.3.13/kWh, while RTC and FDRE projects are competitive at around Rs.5/unit. To ensure grid stability, adoption of storage solutions such as battery energy storage systems (BESS) and pumped storage projects (PSPs) is increasing, aided by viability gap funding (VGF) and investments from CPSUs and IPPs. At the same time, domestic solar manufacturing is gaining momentum, supported by production-linked incentives and regulatory measures, enabling Indian manufacturers to strengthen their competitiveness against Chinese suppliers and positioning the country as a growing solar equipment hub.

Energy Storage Takes Centre Stage

Energy storage is emerging as a key enabler for India’s renewable transition, with RE + storage tenders accounting for nearly 35% of total bids in FY25, a sharp rise from negligible levels before FY24. Battery costs have also seen a steep decline, falling from $800/kWh in 2013 to about $115/kWh in 2024, supported by large-scale Chinese manufacturing and rising global EV adoption. This has translated into competitive tariff discovery, with BESS tariffs hitting a record low in June 2025. Backed by the Ministry of New and Renewable Energy’s two VGF schemes—Rs.3,700 crore for 13.2 GWh and Rs.5,400 crore for 30 GWh—storage-integrated renewable projects such as RTC, FDRE and Peak Power are discovering tariffs at around Rs.5 per unit, placing them on par with thermal power for meeting base load requirements.

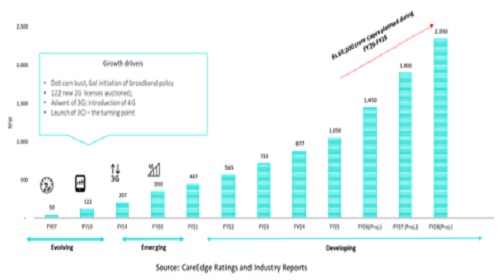

Emerging Growth Areas- Expected to attract investments worth Rs. 60,000 crore between FY26 and FY28

Newer segments of infrastructure are also witnessing rapid growth. The data center industry, powered by rising digitalization, 5G adoption, artificial intelligence, and higher mobile data usage, is expected to attract investments worth Rs. 60,000 crore between FY26 and FY28. With capacity expected to nearly double by 2028 and strong private equity participation, India is fast emerging as a critical data hub in Asia.

Green hydrogen, while a long-term opportunity, faces multiple challenges. India has set a target to achieve production of 5 MMTA by 2030. However, the sector faces funding risks due to high upfront capital requirements, regulatory uncertainties, evolving electrolyser technology, and operational issues related to storage and transportation. High production costs, targeted to reduce to around $2/kg, remain the biggest hurdle to large-scale adoption. Despite these challenges, international policy momentum and domestic incentives could help accelerate progress in this space over the next decade.

"Renewable energy is set to lead India’s future capacity growth, with solar, wind, and storage technologies driving the transition towards a greener energy mix. Falling storage costs, policy incentives, and rising investor interest are accelerating adoption, positioning India to achieve its clean energy goals while balancing sustainability with economic resilience", added Sabyasachi Majumdar.

Above views are of the author and not of the website kindly read disclaimer