Capri Global Capital rises on disbursing over Rs 10,000 crore new car loans to around 94,000 customers in FY24

Capri Global Capital is currently trading at Rs. 222.40, up by 0.45 points or 0.20% from its previous closing of Rs. 221.95 on the BSE.

The scrip opened at Rs. 224.95 and has touched a high and low of Rs. 227.00 and Rs. 220.40 respectively. So far 43648 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 1 has touched a 52 week high of Rs. 289.40 on 05-Mar-2024 and a 52 week low of Rs. 145.26 on 10-Apr-2023.

Last one week high and low of the scrip stood at Rs. 242.65 and Rs. 200.10 respectively. The current market cap of the company is Rs. 18470.41 crore.

The promoters holding in the company stood at 69.89%, while Institutions and Non-Institutions held 14.96% and 15.16% respectively.

Capri Global Capital has achieved a remarkable 75% year-on-year (y-o-y) growth in new car loans and disbursed over Rs 10,000 crore to around 94,000 customers in FY 2024. This represents approximately 2.5%of India's total passenger vehicle market.

Last year, Capri Loans focused on expanding its footprint across the length of the country and established presence at 750 locations in 28 states predominantly in the Tier III cities and Tier IV towns. The lender also increased qualified and experienced work force. In addition to operations ramp up, the NBFC also added a number of banking partners and distributors to support the increasing demand.

This has allowed the company to gain market share from urban and semi urban areas where demand for new cars was at a record new high in FY24. Going forward, the Capri Loans aim to continue the growth of the vehicle finance business by 25%. In order to do so, the company plans a multi-pronged strategy including strengthening its presence across southern states. It also plans to leverage technology to automate a part of the acquisition process through launch of an app in the very first quarter of current financial year. The app is already in the pilot phase. The lender is also willing to explore inorganic means to enter newer categories in vehicle financing.

Capri Global Capital is engaged in the business of providing loans to Micro, Small and Medium Enterprises (MSMEs), providing long term finance for construction of residential houses in India, retail Lending in India and in providing ancillary services related to the said business activities.

Tag News

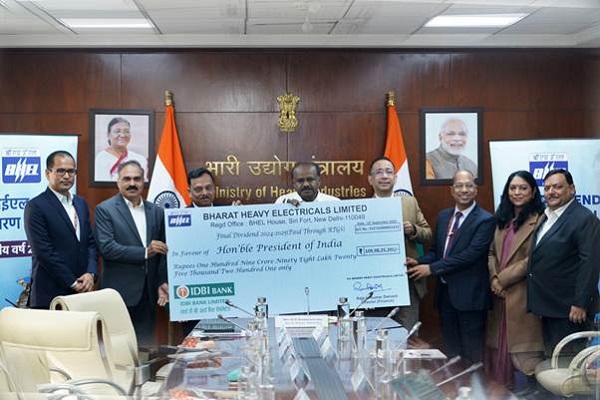

BHEL pays dividend cheque of over Rs 109 crore to government