Buy Birla Corporation Ltd For Target Rs. 1,650 By Choice Broking Ltd

Strong Q2; Better H2 Ahead

Multiple Tailwinds – Volume Growth, Pricing and Premiumisation

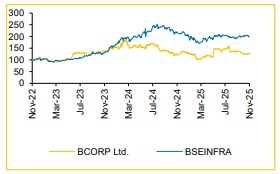

We maintain our BUY rating on BCORP with a TP of INR 1,650/share. Our Volume, Realisation, EBITDA/t and EBITDA assumptions remain unchanged (Exhibit 2). We continue to be constructive on BCORP owing to sector tailwinds, such as 6–8% expected demand growth in the industry and healthy pricing. We are optimistic on the basis of: 1) Expansion drive to increase capacity by 7.5mtpa to 27.5mtpa by FY29E, 2) Strategy towards increasing blended cement share, 3) Sharpening focus on premium products and trade sales to lift realisation and 4) Cost-saving initiative which would drive opex lower by ~INR 200/t over the next couple of years. Hence, ROCE (ex-CWIP) expands by 713 bps, from 6.2% in FY25 to 13.3% in FY28E.

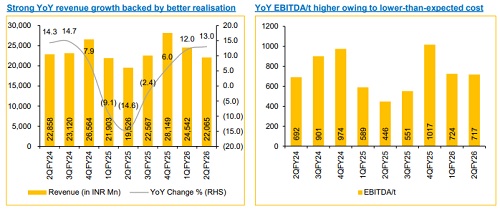

We forecast BCORP EBITDA to expand at a CAGR of 24.0% over FY25–28E based on our volume growth assumptions of 6%/7%/7% and realisation growth of 4.0%/1.5%/0.0% in FY26E/27E/28E, respectively.

We arrive at a 1-year forward TP of INR 1,650/share for BCORP. We value BCORP on our EV/CE framework, assigning an EV/CE multiple of 1.1x/1.1x for FY27E/28E. This we believe is conservative given, the doubling of ROCE (ex-CWIP) from 6.2% in FY25 to 13.3% in FY28E under reasonable operational assumptions. We did a sanity check of our EV/CE TP using the implied EV/EBITDA multiple. On our TP of INR 1,650, the FY28E implied EV/EBITDA multiple is 6.7x, which is reasonable.

Q2FY26 results: Strong performance across the board

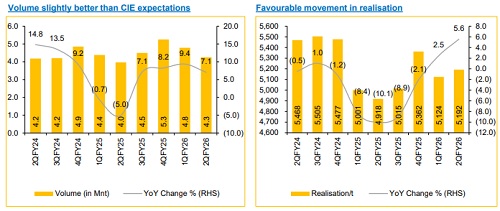

BCORP reported Q2FY26 consolidated revenue and EBITDA of INR 22,065 Mn (+13.0% YoY, -10.1% QoQ) and INR 3,049 Mn (+72.1% YoY, -12.1% QoQ) vs Choice Institutional Equities (CIE) estimates of INR 20,630 Mn and INR 2,240 Mn, respectively. Total volume for Q2 stood at 4.3 Mnt (vs CIE est. 4.1 Mnt), up 7.1% YoY and down 11.3% QoQ.

Blended realisation/t came in at INR 5,192/t (+5.6% YoY and 1.3% QoQ), which is higher than CIE est. of INR 5,021/t. Total cost/t came in at INR 4,474/t (+0.1% YoY and +1.7% QoQ). As a result, EBITDA/t came in at INR 717/t, which is a decline of ~INR 6/t QoQ.

Key Risks:

* BCORP’s future profitability faces a risk if unforeseen operational issues necessitate costly external clinker purchases again.

* Despite focus on 'value share,' the company's limited immediate capacity expansion before 2027 could hinder its ability to grow volume market share against larger and aggressively expanding competitors.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131