Buy AXIS Bank Ltd For Target Rs.1,300 - Emkay Global Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Axis Bank hosted its analyst meet on 23-Nov, to give an update on its GPS (growth, profitability, stability) strategy and the way forward. Bank guides for some systemic growth moderation post the recent RBI action on unsecured/NBFC loans, albeit for own continued outperformance led by its retail+SME growth engine. Bank’s margin is higher by 30bps at 4.1% vs its base guidance of 3.8%; it targets retaining some structural gains due to organic PSL build-up via Bharat Banking and a better portfolio mix, despite rising CoF. Asset quality is holding up well, with NNPA at 0.4% and no immediate sign of stress; but Bank guides for some LLP normalization and plans to uphold contingent provisions for now. However, it guides for an elevated opex, given retail/digital infra build-up causing a drag on RoA@1.8% (>1.9-2% for peers). We believe Bank needs to shore-up its CET 1 (2Q @14.6% vs large peers @>15%), more so post the impact (~50bps) from the recent RBI action; but it guided that it has no such plans, due to its effective capital management/higher RoE (17-18%; partly due to higher leverage). Valuations remain low at 1.6x FY25E ABV vs large peers’ at >2x; thus, we retain BUY with TP of Rs1,300 (on 2x Sep-25E ABV; subs value of Rs83/sh)

AXIS Bank: Financial Snapshot (Standalone)

Higher Retail, SME and Bharat Banking growth to help retain some margin gains

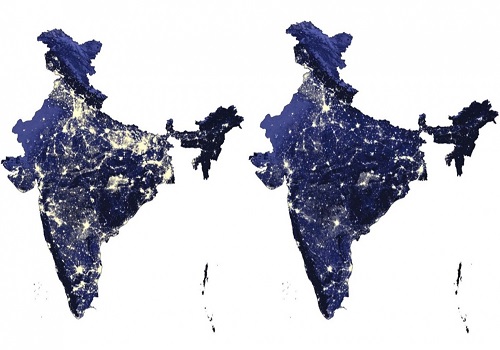

Notwithstanding the potential impact of unsecured loan growth (incl. PL/Cards)—due to RBI action on unsecured/NBFC loans)—on the systemic credit growth (as also for Axis Bank), Bank would continue to outperform, resulting in mkt-share gains led by healthy growth in its retail+SME segments, thereby delivering better RaRoC. Also, Bank would sustain focus on Bharat Banking (incl. MFI, gold, tractor loans, etc), which has led to self-sufficiency in PSL and thus helped reduce the RIDF portfolio (@2.1% from the 5.1% high) and the margin drag. With organic MFI build-up being healthy at Rs60bn without much support from BCs, Bank does not see immediate need for any inorganic acquisition. Incrementally, it plans to accelerate liability mobilization from RuSu (Rural-Semi urban) branches, thereby bringing more stability to its liability profile. Though its LCR remains moderate at 118%, the bank claims that there has been a 550bps reduction in outflow rate in the past 2 years; this underscores its commitment to improve the quality of LCR. Bank reported stable margin in 2Q at 4.1% (which is higher by 30bps from its base guidance of 3.8%) and could see some moderation amid rising CoF. However, Bank targets retaining some gains due to structural improvement, incl. organic PSL build-up via Bharat Banking and improving portfolio mix (retail+SME @69% vs 62% in FY20).

Credit cost to remain soft, but opex to be elevated amid retail/digital infra build-up

Axis Bank has one of the lowest NNPA/retail-NNPA ratios among peers, at 0.4%/0.5%, while its unsecured share is 11% of loans. Given strong PCR on the back book and no immediate sign of asset quality risk, Bank expects credit cost to normalize from current lows, albeit remain soft in the near/medium term. Bank carries contingent provision buffer at ~0.5% of loans and would take a call on reclassifying its Covid buffer or reducing it/shoring it up by year-end. But it guides for an elevated near-term opex, which should gradually moderate to 2% of assets (looks optimistic) as the Citi acquisition drag and heavy infra/digital build-up costs reduce. Further, attrition remains high for AxisB, as also for peers, thus leading to higher cost; but it has taken multiple course corrections—higher employee engagement, pay raises, even offering a better lateral opportunity within the bank—to arrest attrition in key divisions,. Moreover, it believes fee/asset ratio could further improve, led by Cards and neo-initiatives on Wholesale.

We retain BUY

We expect the bank to clock healthy RoA of 1.8% (though lower than peers’ at ≥2%) from a low of 0.8% in FY23, while reporting healthy RoE of 17-18% (partly inflated due to the Citi acquisition goodwill w-off) over FY24-26E, on merged basis. However, Bank needs to shoreup its CET 1 (2Q @14.5% vs large peers’ @>15%), more so post the recent RBI action on unsecured loans. At the CMP, valuations remain reasonable vs peers at 1.6x FY25E ABV. Thus, we retain BUY, with TP of Rs1,300/sh, based on 2x Sep-25E ABV and subs value of Rs83/sh. Key risks: Macro-dislocation leading to slower growth/higher NPAs and KMP attrition.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf

& SEBI Registration number is INH000000354

.jpg)