Bullion rises, recovers losses amid shift from bullishness to caution - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

Bullion moved higher on Thursday, recovering some of the significant losses experienced earlier in the week, as the market transitioned from initial bullish enthusiasm to concerns about an overheating rally. However, any further gains appear likely to be constrained in the short term. Investors are still evaluating the potential for improved relations between the U.S. and China, with President Donald Trump and President Xi Jinping scheduled to meet next week in an effort to ease the ongoing trade tensions. Progress could alleviate some of the geopolitical anxiety that has driven up demand for safe-haven assets like gold.

Crude oil experienced its largest one-day gain in over four months following the U.S. announcement of sanctions against Russia's largest oil companies, which threatens supplies from one of the world's top oil-producing nations. With the recent increase in attacks on Russian oil facilities, these sanctions raise the chances of major interruptions in Russian crude production and exports, leading to possible production halts that could help balance the oversupplied market and support oil prices.

Natural gas prices fell on Thursday due to a larger-than-expected increase in weekly natural gas storage. The EIA reported that natural gas inventories rose by 87 bcf for the week ending October 17, surpassing expectations of an increase of 83 bcf and exceeding the five-year average of 77 bcf.

Copper reached its highest price in two weeks following a bullish near-term outlook among traders highlighted by Goldman Sachs Group Inc. Additionally, the Chilean miner Antofagasta Plc's conservative production target intensified concerns about supply.

On the macro front, market participants are focusing on the U.S. Consumer Price Index (CPI) for September, which is due later today. The market anticipates a 0.4% increase in the headline number and a 0.3% rise in the core figure from month to month.

Gold

* Trading Range: 121080 to 125545

* Intraday Trading Strategy: Sell Gold Mini Dec Fut at 124050-124075 SL 124900 Target 122780/122350

Silver

* Trading Range: 144480 to 150600

* Intraday Trading Strategy: Sell Silver Mini Nov Fut at 149750-149775 SL 151425 Target 147480/146500

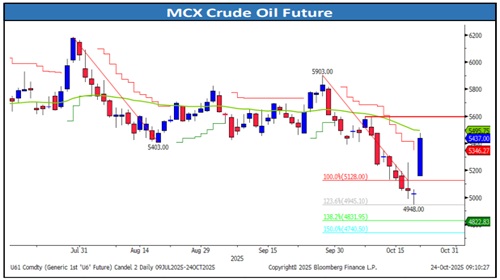

Crude Oil

* Trading Range: 5275 to 5580

* Intraday Trading Strategy: Buy Crude Oil Nov Fut at 5365-5375 SL 5319 Target 5450/5525

Natural Gas

* Trading Range: 275 to 310

* Intraday Trading Strategy: Sell Natural Gas Oct Fut at 294-295.0 SL 303.80 Target 284/280.0

Copper

* Trading Range: 984 to 1006

* Intraday Trading Strategy: Sell Copper Nov Fut at 999-999.80 SL 1004.8 Target 992.80/988.0

Zinc

* Trading Range: 287 to 299.80

* Intraday Trading Strategy: Sell Zinc Nov Fut at 297.8 SL 300.5Target 294.2/292.0.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133