Building Materials : Domestic demand recovery optimism, international trade uncertain by Choice Broking Ltd

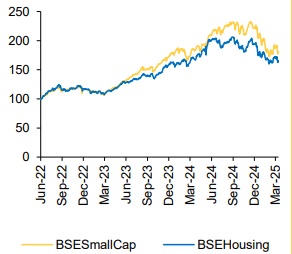

After a weak FY25, we anticipate an improvement in domestic demand across the Building Materials Sector, with Tiles expected to grow by 8%, Bathware by 6%, Pipes by 13%, and Wood & Panels by 12% driven by 1) accommodative monetary policy 2) government focus on housing and 3) absorption of volumes from strong real estate launches of FY24. Tiles segment faced challenges in the export market (volume down 14% for 9MFY25). The ongoing global tariff scenario may throw up interesting new export opportunities for Building Material Sector. At the same time, Indian government needs to be highly vigilant and create tactical barriers as needed to avoid India becoming a soft target for dumping as the global trade order gets reset. We have a Positive stance on the Building Materials Sector, we would continue to monitor how international trade for the sector shapes up. Our Top picks include 1) HINDWARE due to demerger of the loss making Consumer Business and revamp of the Bathware Business. 2) MAN for good traction in the core business coupled with land monetization that generates strong cash flow over the next 5-6 Yrs. (~40% of current market cap) and attractive valuations (FY27E EV/EBITDA multiple of 5.6x). Risks to the sector includes lower GDP growth as a result of softer global growth due to escalation in tariff conflict

Q4FY25E: Basic Materials Sector volume growth is expected to be positive, while profitability across segments would be subdued due to 1) pricing pressure,2) input cost inflation, and 3) rising competition.

Segment wise summary:

* Pipes are expected to grow 18% YoY in volume, driven by real estate (including replacement) & Infra demand, but EBITDA/kg is set to drop 30% due to aggressive pricing and resin price fluctuations.

* Bathware revenues are expected to decline 7% YoY, with a 33% EBITDA drop as weak demand forces higher dealer incentives.

* Tiles may see 3% volume growth, but EBITDA is likely to decline 15% due to discounts and competition from Morbi players.

* In Wood Panels, Plywood is expected to be stable (+7% YoY), but MDF faces oversupply, with overall margins contracting 35 bps due to rising timber costs

Plastic Pipes Sector: Strong Volume Growth Amid Margin Pressure The pipes companies under coverage are expected to report 18% YoY volume growth despite high base, due to market share increase across states. In 4QFY25, domestic resin prices declined 2% QoQ and remained flat YoY. Recently, prices dropped by INR 2 per kg, bringing PVC prices to approximately INR 77.5/kg. EBITDA/kg is expected to fall by 30% in 4QFY25 mainly due to impact of aggressive pricing strategy by other larger competitors and lower inventory at the dealer level. This fluctuation in resin prices is likely to pressure profitability of the plastic pipe sector in the near term.

Bathware Sector : Demand Weakness and Dealer Incentives Erode Margins The Bathware companies under coverage are expected to report a revenue decline of 7% on YoY basis backed by muted real estate demand. But EBITDA is expected to decline by ~33% due to higher incentives being offered to dealers in a weak demand environment and higher competition from unorganized players.

Tiles sector: Modest Volume Growth Offset by Margin Contraction Tiles segment is expected to report a 3% YoY volume growth in 4QFY25, but EBITDA is projected to decline by 15%, with margins contracting by 150 bps due to higher discounts being offered to push the volumes and tough competition from Morbi players.

Wood Panel : Volume Growth Intact, but Higher Timber Costs Hurt Margins We expect Plywood companies to report a subdued volume growth of 7% YoY in Plywood segment. MDF volume is expected to grow by 5% to 48,000CBM. Margins are expected to decline by 35bps due to higher timber prices which increased by 3% QoQ to INR 6.7/kg.

Steel Pipes: Revenue Growth Steady, Margin Gains from Value Added Offering The Steel Pipes company under our coverage is expected to report a revenue growth of 5% YoY. Order book is expected to decline QoQ. Margins are expected to increase by 470 bps led by higher proportion of value added orders.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131