BOK holds key rate unchanged amid weak currency, Donald Trump uncertainty

Despite mounting woes leading to weak growth momentum, South Korea's central bank kept its benchmark interest rate frozen on Thursday in the wake of the weak local currency and uncertainties stemming from the new Donald Trump administration.

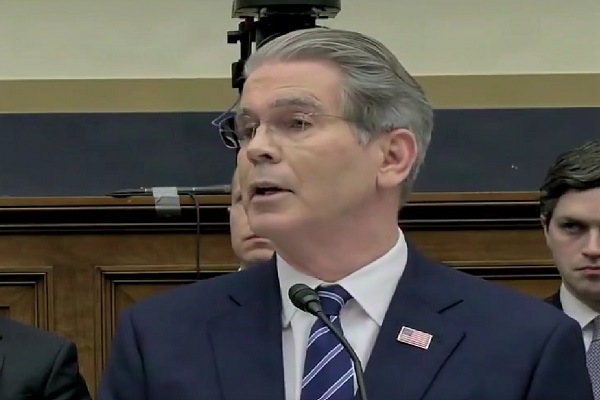

The monetary policy committee of the Bank of Korea (BOK) held its key rate unchanged at 3 percent during a rate-setting meeting in Seoul, reports Yonhap news agency.

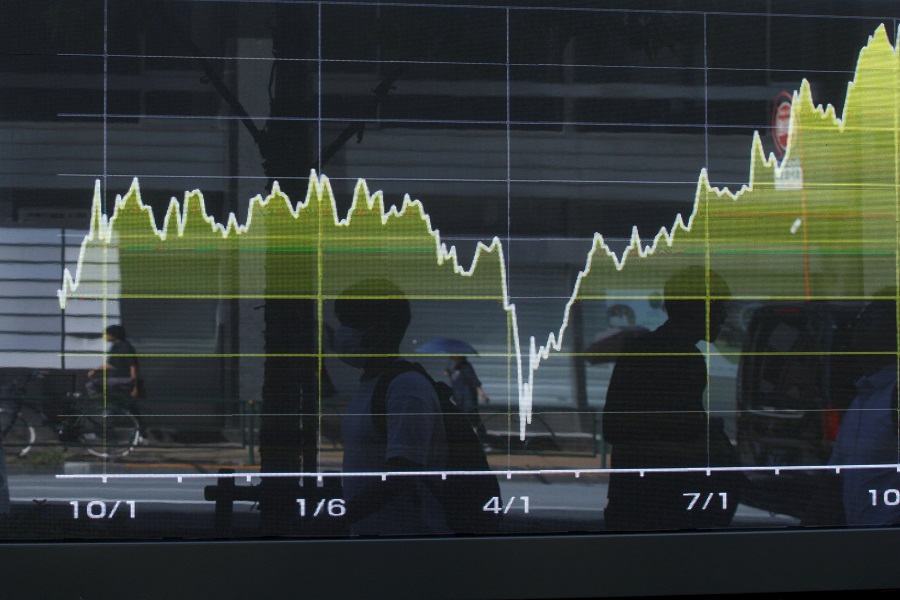

The decision came on the heels of two rate cuts in the prior meetings in October and November, which marked the first back-to-back interest rate cuts since February 2009 when the country was reeling from the aftermath of the global financial crisis.

"As the economic outlook and foreign exchange market uncertainties have increased due to the changing domestic political situation and economic policies in major countries, the board judged that it is appropriate to maintain the current level of the base rate, and to further assess any changes in domestic and external conditions," the central bank said of its decision in a statement.

The decision highlights the BOK's focus on ensuring financial stability, as the local currency recently weakened sharply to well below 1,450 won per dollar, a level unseen since the financial crisis.

The won's weakening came as President Yoon Suk Yeol's shocking martial law imposition caused political turmoil, while U.S. President-elect Trump warned of high tariffs.

The local currency opened at 1,455 won against the greenback on Thursday, up 6.2 won from the previous session.

The Federal Reserve also hinted at a cautious approach to rate cuts this year, scaling back the number of rate cuts it anticipated in 2025 to two from the initial four, which hammered Asian currencies.

A widening gap between the key rates of South Korea and the United States would cause the won to slide further and lead to an outflow of foreign investment from the local market, according to experts.

The on-hold decision keeps the difference at up to 1.5 percentage points.

The weaker won could also cause inflationary pressure.

BOK Gov. Rhee Chang-yong has said the 1,430 won level is likely to push up consumer prices by 0.05 percentage point.

Analysts had been sharply divided on the central bank's policy direction amid calls for the need to prop up weak growth momentum through monetary easing.

The country is facing mounting downside risks, including slowing exports, weak domestic demand and potential U.S. policy changes.

The BOK expected the economy to grow 1.9 per cent in 2025, which is below the potential growth rate of 2 per cent.