Basketonomix (BTX) : Capital Market Basket by Motilal Oswal Financial Services Ltd

• We believe the entire ecosystem of capital market – AMCs, Brokers, Exchanges, Intermediaries, and Wealth Managers – will see sustained revenue growth of 17-45% CAGR over FY24-27.

• We expect gradual recovery in volumes along with increased retail participation, to support the ongoing growth trajectory of brokers and exchanges.

• Improvements in equity mutual fund flows, driven by industry initiatives to raise awareness and enhance financial literacy, will foster long-term investment perspective that is favourable for AMCs.

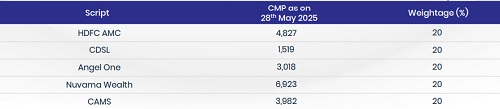

Capital Market Basket

• HDFC AMC: HDFC AMC remains a strong player in the mutual fund industry, backed by robust financial performance, steady AUM growth, cost efficiency and a strong retail presence. -With an improved market position, a well-diversified product portfolio, and digital expansion efforts, it is well-positioned to sustain growth and deliver value to its stakeholders.

• CDSL: We believe CDSL is well placed to garner strong revenue and PAT CAGR driven by India’s capital market growth story and the financial inclusion theme. The duopolistic nature of the business, plenty of opportunities to scale up, low capex requirement and cash-rich balance sheet make CDSL a long-term steady compounder.

• Angel One: ANGELONE has cemented its position as the third-largest brokerage firm in India, boasting a clientele of 28m, with 7.5m NSE active clients as on Dec’24. During FY24-27, we expect a revenue/PAT CAGR of 24%/ 25%, driven by sustained momentum in customer acquisition, expansion of the MTF book, and improved realizations going forward.

• Nuvama Wealth: Nuvama is a play on multiple themes in the capital market space, including UHNI wealth management, affluent segment wealth management and AMC. We expect Nuvama to deliver a CAGR of 23%/24%/29% in AAUM /revenue/ PAT over FY24-27, led by growing wealth management and asset management business.

• CAMS: CAMS is a direct play on the growing financialisation of savings in India and is also a key enabler for digitization in the mutual fund (MF) industry. We project CAMS to report overall PAT CAGR of 26% during FY24-27, led by growing MF AUM and increasing share of non-MF businesses in the overall mix

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Invesco Asset Management (India) announces change to OPA