Basic Materials – Building Materials : Q2FY26 Quarterly Results Preview by Choice Broking Ltd

Building Materials Sector: Growth across Segments, but Margins Under Strain

In Q2FY26, we expect mixed volume growth trends for the Building Materials sector across segments, but, at the same time, margin would be under pressure. Pipes volume is expected to grow 11% YoY, driven by Real Estate, Infra and Home Improvement demand. EBITDA/kg is set to decline by 12% YoY due to increase in mix of lower margin products for our coverage companies. Bathware segment revenue is anticipated to increase 7% YoY. Tiles segment is projected to see 5% volume growth YoY. In Wood Panels segment, Plywood/MDF volume would remain flat while MDF segment would report volume growth of 9% YoY, with overall margin expected to improve by 65.2bps due to price hike in the plywood segment and better product mix.

Overall, the Building Materials sector would witness mixed volume growth trends, lead by pipes and wood panels followed by bathware and tiles segments. Overall, profitability is expected to remain under pressure due to higher raw material prices and dealer incentives, amongst other

Any disappointment on the volume growth front in this quarter would be pardoned by the market if management commentary indicates a sharp recovery in H2FY26.

Sector View

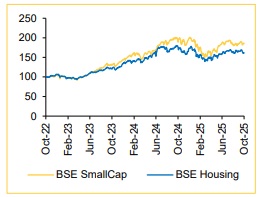

We maintain our Positive Stance on the Building Materials sector backed by Healthy Home improvement and Infra demand. The volume growth, better product and Strong order book will be the key catalyst. going forward. Our preferred ideas are: HINDWARE & MAN.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131