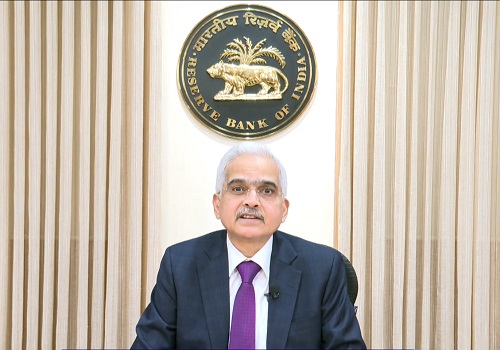

Banks must be fair in conduct with consumers: RBI chief

RBI Governor Shaktikanta Das on Friday said banks and NFCs must be fair in their conduct and practices with consumers as this fosters confidence and public trust in financial institutions which strengthens their stability.

He pointed out that RBI has issued guidelines on Key Facts Statement (KFS), penal charges in loan accounts, reset of floating interest rate in EMI-based personal loans, and release of movable or immovable property documents on repayment or settlement of loan accounts.

"However, we still come across instances of regulatory entities resorting to high-handed recovery practices, framing non-transparent loan contracts with inadequate disclosures of important terms or non-disclosure of charges, levying excessive interest rates, especially in microfinance loans," he lamented.

"Fair conduct is not just a regulatory requirement, it is a core business requirement. I am emphasising on this issue of fair conduct because conduct risks may arise even when the going is good, as it prevails now. Conduct risk needs to be seen together with risk culture," he added.