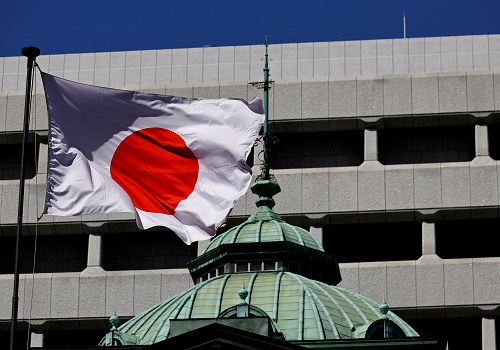

Asia stocks extend gains, yen retreats after BOJ talks down rate hikes

Asian share markets extended gains on Wednesday led by a bounce in the Nikkei, following the Bank of Japan's unexpected indication of reluctance to further raise interest rates while markets are volatile, which lead to a sharp fall in the yen.

The Nikkei's 2% rise followed Tuesday's 10% rally, leading to optimism investors were finding their footing after the recent market rout. The index slumped 13% on Monday.

Bank of Japan (BOJ) Deputy Governor Shinichi Uchida said on Wednesday the central bank won't raise interest rates when financial markets are unstable.

The dollar jumped 1.6% to 146.65 yen and away from the 141.675 trough hit on Monday, though it remains far below its July peak of 161.96. [USD/]

"The sell-off in Japanese stocks may almost be over," said analysts at JPMorgan in a note. "Both nonresident and individual investors have reset their year-to-date net buying."

"If the market stays at its current level, the GPIF (government pension fund) could become a net buyer by end-September, and a view that unwinding of yen carry trades is almost over has also emerged."

The GPIF is a massive fund with considerable market power and its investment decisions are highly influential.

The unravelling of the yen carry trade - where investors borrow yen at low rates to buy higher yielding assets - was a driving force in the market rout, but again seemed to be stabilising.

MSCI's broadest index of Asia-Pacific shares outside Japan jumped 1.3%, while Korean stocks added 2.7%. China's blue chip index rose 0.4% while Hong Kong's Hang Seng index gained 1.3%.

After Wall Street bounced overnight, Nasdaq futures rose 0.6% despite a 12% dive in AI darling Super Micro Computer after it missed earnings estimates.

S&P 500 futures were also up 0.3% while EUROSTOXX 50 futures firmed 0.8%. FTSE futures added 1%.

With safe-haven in less demand, Treasury yields ticked higher for a second session. U.S. 10-year yields were up at 3.9165%, and well off Monday's low of 3.667%.

Two-year yields climbed back to 4.0163%, from a deep trough of 3.654%, as markets scaled back wagers on an intra-meeting emergency rate cut from the Federal Reserve.

Futures now imply 105 basis points of easing this year, compared with 125 basis points at one stage during Monday's turmoil, while a 50-basis-point cut in September was seen as a 73% chance.

Fears of an imminent U.S. recession had also faded a little as the run of economic data still pointed to solid economic growth in the current quarter.

The Atlanta Fed's much-watched GDP Now estimate is that gross domestic product is running at an annual pace of 2.9%.

In commodity markets, gold prices slipped 0.2% at $2,383.77 an ounce and short of last week's $2,477 top.[GOL/]

Oil prices remained volatile as concerns about waning global demand warred with the risk of supply disruptions in the Middle East. [O/R]

Brent eased 0.3% to $76.23 per barrel, while U.S. crude fell 0.4% to $72.87 a barrel.