Asia ponders Fed fallout, bonds still bullish on rate cuts

Asian shares faltered on Thursday after Wall Street took a late spill, while investors stuck to bets for sizable cuts in U.S. interest rates this year even if the kick off might now be a little later than first hoped.

The Federal Reserve committee's decision to hold rates at 5.25-5.5% on Wednesday was no surprise, it took a dovish twist by emphasising that rates would not be cut until it had more confidence that inflation was truly beaten.

In a media conference, Fed Chair Jerome Powell flatly stated a cut as early as March seemed unlikely, but also conceded that everyone on the committee was looking to ease this year.

"One of the more dovish aspects of Powell's remarks was the asymmetry on employment: strong employment gains won't necessarily forestall rate cuts, but weak employment gains would 'absolutely' hasten rate cuts," wrote analysts at JPMorgan.

"We are sticking with our call for a first cut in June, but after Powell's remarks it's not hard to see a configuration of employment and inflation data that gets the Committee cutting by May."

Indeed, markets actually doubled down on a May move, pricing in 32 basis points of cuts - implying a 100% probability of 25 basis points and some chance of a 50 basis-point easing.

"We have pushed back our forecast of the first cut from March to May," said analysts at Goldman Sachs. "However, we continue to expect 5 cuts in 2024 and 3 more in 2025 because we expect core inflation to fall at least a couple of tenths below the FOMC's median projection this year."

Investors also seemed to be wagering that more the Fed delayed now, the more aggressive it would have to cut in the future given slowing inflation would sharply lift real rates.

As a result, Fed fund futures for December have priced in a further 13 basis points of easing this year taking the total expected to 143 basis points.

Likewise, Treasuries rallied strongly as 10-year yields dived 12 basis points to 3.91% in the wake of the Fed decision. Some of those gains were then pared in Asia, nudging yields up to 3.950%.

BANK JITTERS

The rush into bonds was further encouraged by renewed jitters over regional U.S. banks when New York Community Bancorp crashed 37% to the lowest in over two decades after posting a surprise loss.

That spilled over into other bank stocks and contributed to a sharp pullback in the S&P 500 late Wednesday, while the Nasdaq had already been pressured by falls in Alphabet Inc and Tesla. [.N]

By early Thursday, sentiment had steadied and S&P 500 futures added 0.2%, while Nasdaq futures firmed 0.3%. The market faces a major test later in the day when results are out from Apple, Amazon and Meta. [RESF/US]

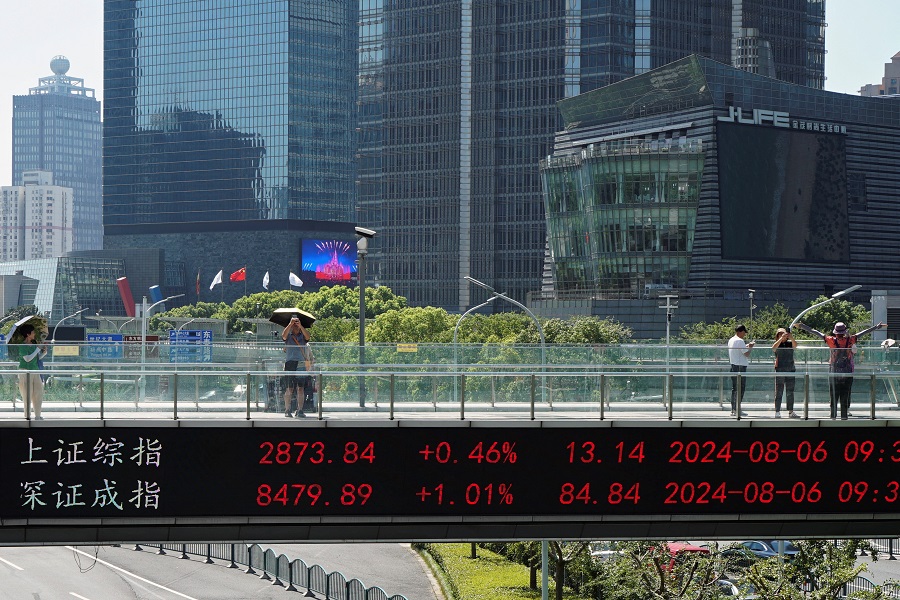

The choppy trading left Asian markets cautious and MSCI's broadest index of Asia-Pacific shares outside Japan dipped 0.3%.

Japan's Nikkei eased 0.5% as the yen gained, while South Korea bounced 0.7% as a survey showed factory activity growing for the first time in 19 months.

Chinese blue chips eased 0.4%, still smarting from a disappointing January factory survey.

Currency markets were jolted by the mixed reaction to the Fed, with the dollar gaining on the euro but losing to the yen as bond yields slid.

The euro was left at $1.0805, after ending Wednesday down a slight 0.2%. The dollar was holding at 146.86 yen, having fallen as far as 146.00 at one stage overnight. [US/]

Gold also gyrated in the wake of the Fed, and was last up a fraction at $2,040 an ounce. [GOL/]

Oil prices were near flat, having retreated on Wednesday amid worries about demand from China and a surprise build in U.S. crude inventories. [O/R]

Brent futures edged up 12 cents to $80.67 a barrel, while U.S. crude rose 10 cents to $75.95 per barrel.