Arbitrage Expiry Analysis note By JM Financial Asset Management

Key Highlights

• Total number of stocks available in Futures and Options (“F&O”) segment in October series were 184 (Large cap – 85, Midcap – 75, Small cap – 24) as compared to 184 in September series (Large cap – 85, Midcap – 75, Small cap –24).

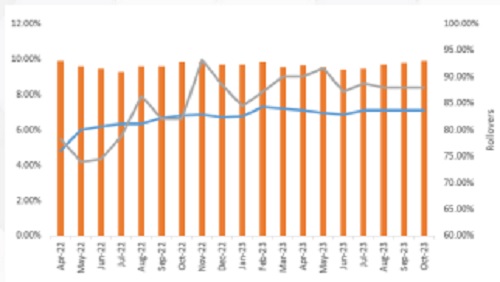

• Rising US bond yields, volatile commodity prices and fresh round of geopolitical tensions in the middle - east have led to a sharp bout of risk-off across the globe. For October series, Nifty Index declined by 3.4% while the Midcap Index and Small-cap Index also declined by 4.5% and 2.9%, respectively. Market-wide rollovers at ~91% were in-line with its 3 months average rollovers of ~91%.

• Market-wide rollovers at ~92% were above its 3 months average rollovers of ~91%.

• Average roll levels across stock futures during the expiry week were ~65-67bps (cost to long rollers).

• We feel that the markets in CY’23 could be volatile due to new flows related to geopolitical tensions, US Fed rates and inflationary pressures globally.

Index Performance

• Rising US bond yields, volatile commodity prices and fresh round of geopolitical tensions in the middleeast have led to a sharp bout of risk-off across the globe. For October series, Nifty Index declined by 3.4% while the Midcap Index and Small-cap Index also declined by 4.5% and 2.9%, respectively. In terms of flows, FIIs were sellers while DIIs continue to remain buyers. While the participation of HNIs and Retail investors is not officially reported, their influence on the market must have undoubtedly been significant

Rollover Analysis

• Market-wide futures open interest at the start of November series is at ~INR 2.71tn as compared to ~INR 2.86tn at the start of October series. Nifty futures will start the November series with an Open Interest of INR 219bn as compared to INR 204bn at the start of September series. Single Stock futures Open Interest stood at INR 2.40tn as compared to INR 2.56tn at the start of October series.

• Average roll levels across stock futures during the expiry week were ~65-67bps (cost to long rollers). In terms of open interest positioning, FIIs have increased their short position in both Index and stock futures.

• In October series, on sectoral front Auto, FMCG and Realty were major outperformers while PSU Bank, IT and Metals were major underperformers. Market-wide rollovers were at ~92% which is above its 3 months average of ~91%. Stock futures rollovers stood at 94%, which is above its 3 months average of 93% .

Flow Analysis: Institutional Flows

The FIIs pulled out USD 2bn in October while DIIs pumped in USD 3.1bn.

Outlook

• In terms of key events from where markets will look for cues in November are geopolitical events, rising US bond yields and Q2FY’24 earnings season.

• We feel that the markets in CY’23 would be volatile due to global macro uncertainty. Volatility in the markets could help to churn the arbitrage portfolio and generate good returns.

• Annualised Roll spreads of Top 50 stocks in October’23 were in-line with the spreads in September’23.India Government Security 1year Yield remained flat in October’23 as compared to Septembe’23.

• Market wide Rollovers were above in October’23 as compared to September’ 23.

Above views are of the author and not of the website kindly read disclaimer

More News

Stock Insights : HCLTech Ltd, Indegene Ltd, Insolation Energy Ltd, KPI Green Energy Ltd, L&T...