Ajmera Realty`s revenue up 20%, presales up 48% in H1 FY26 - Accelerating towards annual guidance

Ajmera Realty & Infra India Ltd. (BSE: 513349 | NSE: AJMERA), one of India’s most trusted and legacy-driven real estate developers, announced its financial results for the quarter ended 30th September 2025.

Key Highlights for H1FY26:

- Revenue grew 20% YoY to INR 481 Cr

- EBITDA grew 6% YoY to INR 139 Cr

- PAT grew 2% YoY to INR 71 Cr

- Sales Value surged 48% YoY to INR 828 Cr, driven by strong demand across new launches

- Sales Volume grew 20% YoY to 2,93,016 sq.ft.

- Collections grew 52% YoY to INR 454 Cr, reflecting efficient execution and strong customer confidence

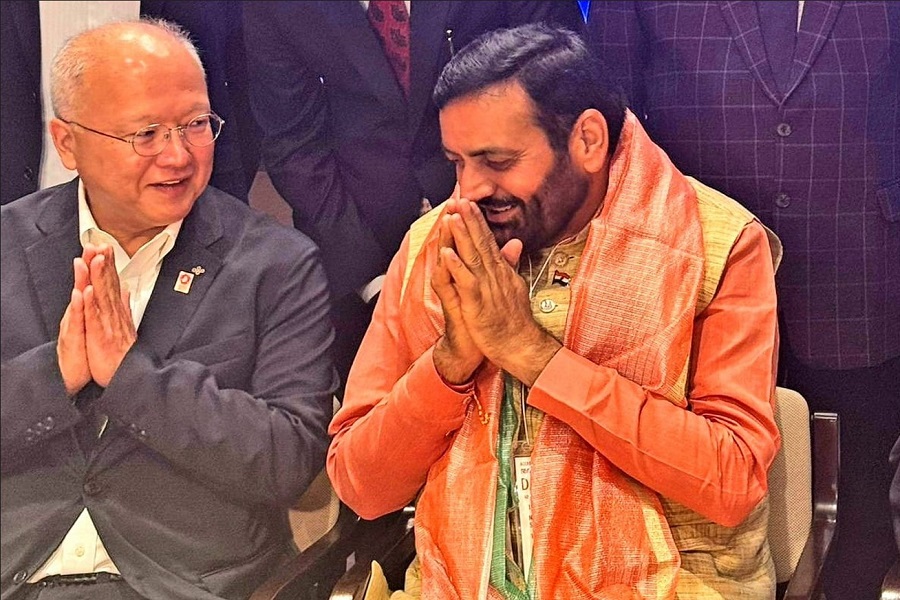

Commenting on the Q2 & H1FY26 performance, Mr. Dhaval Ajmera, Director - Corporate Affairs said: “The Q2 and H1FY26 performance further reinforces our focus on disciplined growth, timely execution, and prudent financial management. During the quarter, we launched two marquee projects — Ajmera Manhattan 2 and Thirty3.15 — with a combined GDV of Rs 2,100 crore, both receiving an encouraging market response. Strengthened balance sheet with a healthy debt-to-equity ratio of 0.55x, supported by robust sales momentum and strong collections, resulting in a well-optimized debt structure. With a strong project pipeline of GDV of INR 4,357 Cr across seven projects and strong demand visibility, we remain focused on maintaining this growth trajectory through strategic launches, robust pipeline, operational excellence, and a balanced approach to financial prudence.

The outlook on development potential of Wadala stands robust with a lucrative line-up projected to generate a top-line sales value of over INR 12,000 Cr. During H2FY26, we plan to launch a boutique office space with estimated carpet area over ~6 lakh sq.ft with an estimated GDV of INR 1800 Cr. Further FY27 onwards, we aim to foray into uber-luxury residential space and launch a project spreading across ~13.8 lakh sq.ft, estimated to generate a GDV of INR ~5700 Cr. Further, the next phases of Ajmera Manhattan to be developed across ~9 lakh sq.ft that will add an estimated GDV of INR ~3200 Cr.”

Operational Highlights: Q2 & H1 FY26:

Financial Highlights: Q2 & H1 FY26:

Above views are of the author and not of the website kindly read disclaimer