Add Tech Mahindra Ltd For Target Rs. 1,560 By JM Financial Services

Transformation phase 2 - A litmus test?

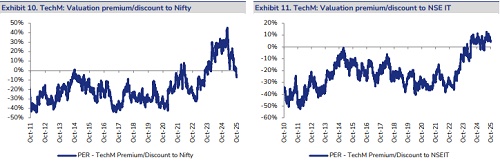

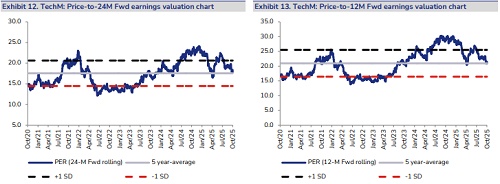

TECHM reported 1.6% cc QoQ growth (JMFe: 1%), its highest sequential growth in past three years. This reflects, in our view, contribution of improved deal wins in past few quarters, stability in its top telco account, limited client-specific challenges (barring one EU telco) and its focussed efforts on mining USD 20mn+ accounts. These, along with seasonality – holiday season in 3Q and Comviva in 4Q – likely inform its better 2H outlook as well. That said, by management’s own admission, growth acceleration in FY26 and possibly FY27 is tracking below what they had assumed at FY25-beginning. Besides, their commentary that in the absence of discretionary pick-up, TCV run-rate needs to step up to USD 1bn (from c.USD 800mn currently) for them to achieve their growth target suggests FY27 growth visibility is limited at this stage. We therefore cut our FY27E USD revenue growth to 4.6% cc (from 5%), aligned with that of larger peers. Margin expansion, on the other hand, has so far been de-linked with growth/macro, as it was led mainly through G&A optimisation. Now with incremental expansion dependent more on gross margin expansion, growth will likely play a role. We have therefore largely retained our FY27 EBIT margin estimate despite 2Q beat. Besides, higher tax rate drives 2-3% cut to our FY26-27E EPS. TECHM’s consistent progress towards its stated goals is impressive, though well discounted in the price. Incremental re-rating/EPS upgrades should therefore track improvement in growth visibility, in our view. We retain ADD.

* 2QFY26 – Strong performance: Revenues grew 1.6% cc QoQ vs JMFe/Cons. est of 1%. Growth was led by retail and logistics (+9% USD), Manufacturing (5%) and BFSI (4%). Among geographies, Americas grew 2.6% QoQ but declined 2.7% YoY due to challenging macro, EU grew 5.7% YoY while ROW was stable YoY. EBIT margin expanded 108bps QoQ to 12.1% vs JMFe/Cons. est of 11.1%. Margin expansion was driven by productivity gains in FPP, better volumes, SG&A optimisation (SG&A was down 50bps QOQ) and FX, FX aided margins by 40bps. PAT came in at INR 11.9bn - 4.7% QoQ/3% YoY (vs JMFe/Cons. est of INR 12.9bn). Adjusting for the exceptional item (sale of land) in 2QFY25, PAT growth was 36% YoY. PAT was impacted by lower other income due to FX losses. On the supply side, headcount grew by 4.2k sequentially (-1309 YoY) in 2Q led by addition in BPO, Onsite mix increased 30bps and attrition came in at 12.8% (vs. 12.6% in 1Q). The company announced a dividend of INR 15.

* Outlook – 2H better than 1H: TECHM won USD 816mn in net new TCV (LTM TCV: USD 3.17bn; +57% YoY). Deal wins were broad-based across across communications, manufacturing, BFSI, retail, and logistics verticals. Management indicated that above industry growth in FY27 would hinge on either deal wins (net new) nearing the USD 1bn mark or discretionary demand picking up. While FY27 growth outlook has been moderated versus initial expectations at the start of FY25, it is expected to be better than FY26. 2H26 is expected to be stronger than 1H, driven by ramp up of deal wins and focused efforts towards larger clients. Management remains committed to their FY27 EBIT margin target despite lowered growth outlook for FY27. Further EBIT margin expansion will involve greater effort, with incremental expansion expected primarily from improvement in gross margins. Productivity in FPP, delivery optimization and integration of portfolio companies are expected to be key margin levers.

* EPS revised (3%)-1%; Retain ADD: We have marginally lowered revenue est. to align growth rates with large cap peers. It also reflects management view that deal TCV needs to improve to USD 1bn (from USD 800mn currently) to drive industry leading growth. Our FY26-27E EPS is revised lower by (3%)-1% due to higher tax rate/ finance cost assumptions. Maintain ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361