We witnessed positive momentum in the banking space - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

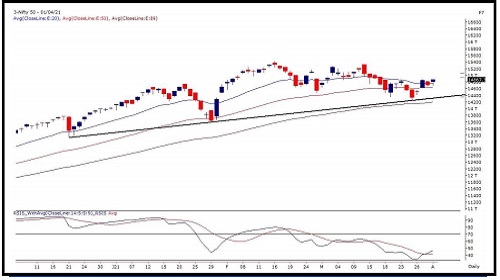

Sensex (50030) / Nifty (14867)

After an extended weekend, our markets opened on Tuesday with a good bump up on the back of favourable cues from the global bourses. The initial lead extended as we witnessed a good broad based participation to clock more than a couple of percent gains. This was followed by a subdued session with few pockets kept sulking to trim some of the gains.

However once again on Thursday, the buying resumed across the board to reclaim the 14800 mark and with this managed to secure the weekly gains of nearly two and half a percent to kick off the new Financial Year on a positive note. Despite being a truncated week, it was not at all short of actions as we saw good traction in some of the individual pockets, especially on the last session.

The index is currently undergoing a timecorrection and hence, it remained in a small trading band throughout the week. As far as levels are concerned, 14900 followed by 15050 remains to be a sturdy wall; but the way its placed now due to Thursday’s late surge, the possibility of testing and even going beyond this cannot be ruled out.

The hourly chart exhibits a configuration of a bullish ‘Cup and Handle’ pattern and any sustainable move beyond 14900 would strengthen this structure to attract some buying interest in the heavyweight constituents as well. On the flipside, 14800 – 14670 are to be seen as immediate supports. The mentioned bullish structure will get negated if Nifty slides below 14670 and hence, one should keep a close tab on how the overall move pans out in the first half of this week.

In the week gone by, the financial stocks did not participate much in Tuesday’s up move but they proved their significance on the last day as it single-handedly propelled the Nifty beyond 14800 towards the fag end on the weekly expiry session.

This space plays a vital role if our benchmark has to move beyond the 15000 mark. Apart from this, the metal stocks had a mesmerizing rally throughout the week as some of the steel counters soared as if there is no tomorrow. Yes, the low hanging fruit is already gone for momentum traders but it would certainly be interesting to see how they perform going ahead. Importantly, the stocks from the cash segment did exceedingly well after a lull period of nearly four weeks. It’s advisable to focus on such potential movers.

Nifty Daily Chart

Nifty Bank Outlook - (33858)

On Thursday, the bank nifty started on a positive note however from the word go it crept lower to test levels around 33200. Subsequently in the second half buying was seen from lower levels that not only crossed the morning high but to end well above it with gains of 1.66% at 33858. Quite similar to the Nifty chart, we can also see a cup and handle formation on the hourly chart of Bank Nifty and the interesting point in the bank index is that the breakout levels coincide with the 50EMA on the daily chart placed at 34000 levels.

During the fag end on Thursday, we witnessed positive momentum in the banking space and if the momentum sustains in the initial start of the week then we can expect the said pattern breakout opening doors for further extension of upmove. In such a scenario, 34000 followed by 34300 is the key level to watch on the upside whereas on the flip side the positive structure remains intact as long prices hold 33150 levels. Traders are advised to keep a tab on the above levels and trade accordingly.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One