We may see some consolidation in the index ahead but the tone is likely to remain positive - Religare Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty Outlook

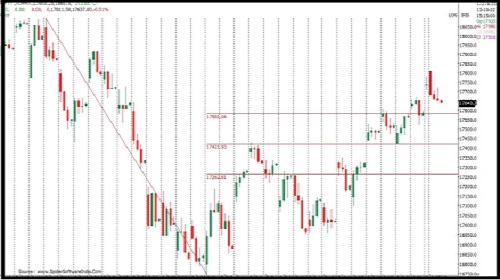

Markets witnessed profit taking amid mixed cues and lost over half a percent. After the initial uptick, the Nifty index gradually inched lower and settled closer to the day’s low at 17,656.40 levels. Meanwhile, the trend was mixed on the sectoral front wherein FMCG and energy majors were under pressure while auto and IT tried to save the day. Interestingly, the broader indices outperformed the benchmark and ended almost on a flat note.

While the global markets are still not portraying any clear trend, the recent buying in heavyweights especially from the banking pack has lifted the sentiment. We may see some consolidation in the index ahead but the tone is likely to remain positive. The focus should remain on identifying stocks from the sectors which are participating in the move, without losing focus on risk management citing volatile global markets and prevailing earnings season.

News

Foresight selects the IntellectAI suite of products for intelligent automation of their Workers Comp line of business. The Workers Comp MGU will use Magic Submission, Risk Analyst and Xponent to deliver more efficient and innovative experience to Foresight’s brokers and clients

ABB India has been conferred with the 9th Indian Green Building Council (IGBC) Green Champion Award under the category of ‘Pioneer in large scale adoption of Green Factory Buildings in India’, to recognise and honour organisations that have embraced sustainable goals and have the potential to inspire others, thereby advancing the Green Building Movement in India.

Alembic Pharmaceuticals has successfully completed the (USFDA) inspection for its Bioequivalence Facility located at Vadodara without any observations. The inspection was conducted from 17th October, 2022 to 21st October, 2022.

Derivative Ideas

NIFTY shed 0.42% and closed at 17656.35 on 25th Oct. The index witnessed some profit taking ahead of its monthly expiry. However the structure still remains positive. With Put base seen at 17500 in Nifty, we expect the index to trade with positive bias in the short term in the range of 17500-17750 thus suggesting selling PE as per the given levels.

Strategy:- SELL NIFTY 3 NOV 17100 PE @ 38-40, STOP LOSS 60, TARGET 5.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

The current key support holding near 14650 - Enrich Commodities