Trading for the week started on a flat note owing to muted global cues - Angel Broking Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Sensex (49744) / Nifty (14676)

Trading for the week started on a flat note owing to muted global cues. However, without wasting much of a time, Nifty slid into the negative terrain. The selling pressure augmented as the day progressed and all attempts of a rebound were comfortably getting sold into. Due to tail end correction, Nifty ended the session with a cut over couple of percent, marking biggest loss in the February month.

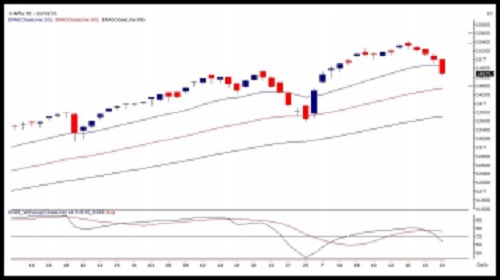

Throughout last week, we maintained our cautious stance on the market and suggested exiting longs in the zone of 15200 – 15400. In last couple of sessions, we had seen a glimpse of profit booking which eventually turned into a decent correction yesterday to break some key supports. The Nifty has now reached to our first target of 14750 and the way its placed now, 14550 – 14470 is very much on cards. As of now, these levels should be considered a key support zone; but one needs to see how market behaves after entering it. Yesterday, the banking space did not participate to the tune of benchmark in the correction; but going ahead, if we see BANKNIFTY sliding below its key support of 35000, it will drag the Nifty towards 14300 as well. Hence, the coming session would be quite crucial, especially for banking stocks. As far as Nifty is concerned, it has broken below ’20-day EMA’ and hence, any bounce towards 14775 – 14850 is likely to get sold into.

Nifty Daily Chart

Nifty Bank Outlook - (35257)

The Bank Nifty aswell started on a flat note and along with the broader markets continue to crept lower to end with a loss of 1.63% at 35257. For the fifth consecutive session, the bank index witnessed correction and has now erased around 2500 from all-time high levels. Yesterday, the quantum of fall was relatively less as compared to the benchmark index as the bank nifty has approached the key support of 35000. Going with the current momentum it seems that the support levels can be broken however with the monthly expiry lined up; we would keep a close watch on the same. A break below it can trigger a fresh leg of downside whereas if prices manage to hold then we may see some bounce back. Traders are advised to keep a tab on the same and trade accordingly. Below, 35000 the next support levels are placed around 34700 whereas, on the flip side, 35650 - 35800 is the immediate resistance zone.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Selling pressure persists at D-street