The week started on a positive note but post the initial surge there was no major traction in the bank index - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (60115) / Nifty (17936)

The SGX Nifty was indicating a muted start yesterday morning. Despite this, our benchmark index opened with a decent upside gap taking US markets’ Friday’s rally into consideration. The opening lead got extended in the initial hour itself beyond 17950. However, the movement in most of the heavyweights became stagnant thereafter and hence, the Nifty remained in a slender range throughout the remaining part of the session. Eventually, it concluded with more than half a percent gains convincingly above the 17900 mark.

Although, key indices are lacking a bit of momentum, the undertone seems strongly bullish and as a result, the Nifty is now within a touching distance of the psychological mark of 18000. It’s merely a formality now, we would see it actually on the screen very soon. The real question is, does market have enough legs to move beyond it to touch the record highs. In our sense, it’s happening sooner or later. Before this, a move towards 18200 – 18350 in near future is clearly on cards. This view remains valid as long as Nifty defends 17700 – 17600 on a closing basis.

Yesterday, the banking had a fantastic start but follow up was missing. Never mind, we reckon, BANKNIFTY is headed towards its all time high before the benchmark index. Also, the IT showed its willingness to participate for the second straight session, which again is an encouraging sign. In our sense, one should continue to remain positive and even if key indices consolidates a bit, the stock specific action is likely to continue.

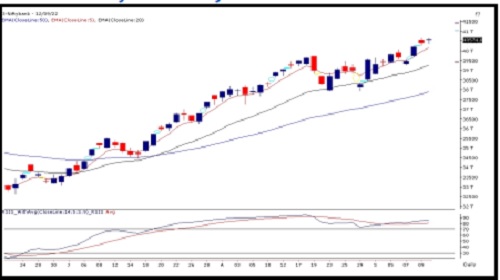

Nifty Bank Outlook (40574)

The week started on a positive note but post the initial surge there was no major traction in the bank index. For the major part, the index consolidated in a range and ended with gains of 0.34% at 40574.

The bank nifty has been the major contributor to the recent up move in the broader markets and is placed in a sweet spot above the multimonth breakout levels of 40000. We sense it is headed towards the all-time high levels of 41829; hence any dip should be taken as a buying opportunity. In such a scenario, immediate support is seen at 40280 and 40100 levels whereas resistance is seen at 40750 - 41000 levels.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One