The sacrosanct level of 17000 once again proved its mettle - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

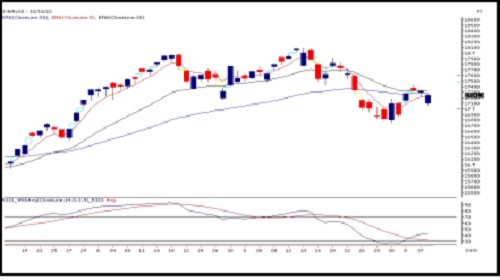

Sensex (57991) / Nifty (17241)

On Friday, despite better macro economic data, US markets reacted negatively and ended the week on a pessimistic note. This certainly spoiled global sentiments and hence, SGX Nifty yesterday morning indicated a gap down opening with more than 200 points cut. In line with this, Nifty opened below 17100 and then tested the 17050 mark. Fortunately, bulls cushioned this fall and managed to pull the index during the remaining part of the session. Eventually, we managed to restrict losses to merely four tenths of a percent to conclude the session comfortably above 17200.

The sacrosanct level of 17000 once again proved its mettle. In spite of not so favorable global environment, our markets managed to recover fair bit of ground; courtesy to recent laggard IT space, which has shown some sign of revival ahead of quarterly result of IT giant, TCS. We continue to remain sanguine as long as key support zone of 17000 – 16800 remains intact and meanwhile, the buy on declines approach remains the key. For the coming session, intraday supports are now visible at 17140 – 17050; whereas a move above 17300 would trigger a short covering move towards 17400 and beyond.

Nifty Bank Outlook (39093)

Bank Nifty as well started with a gap-down opening however there was no follow-up weakness after that and there was a sharp recovery to reclaim the lost ground and cross above Friday's high. Subsequently, there was tentativeness at higher and the bank index eventually ended with a minor loss of 0.22% tad above 39000.

Even though there was no major change in the price structure as per the index; there was strong traction and buying from lower levels seen in the private and PSU banking space. On the daily chart, we are witnessing a positive cross in the momentum indicator RSI Smoothened and hence we remain upbeat on this sector. Traders are therefore advised to avoid contra bets and use any dips as yesterday as a buying opportunity. As far as levels are concerned, 38600 - 38400 seems to be a strong demand zone whereas 39600 followed by 40000 is an immediate resistance zone.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One