The rupee witnessed a further bounce and managed to gain almost 18 paise - ICICI Direct

INR Futures

* The rupee witnessed a further bounce and managed to gain almost 18 paise in the last session to close near 73.36 levels against the US dollar

* The dollar index moved below 91 levels once again amid softening bond yields. US 10-year yields have remained largely below 1.40% level after testing the 52-week high on Friday

Global Bonds

* The Nifty opened higher and held firm above 14750. In the final half hour, a sudden surge in heavyweights helped it to end near the day high. According to option data, 15000 Call option has significant OI, which should act as resistance while on the downside, 14800 and 14700 has noteworthy OI, which should act as support

* The Bank Nifty opened higher and saw intraday correction where it took the support of 35000 Put base as it reversed from those levels

FII & FPI Activities

* Foreign institutional investors (FII) remained net buyers to the tune of | 78 crore on March 1, 2021. They bought worth | 849 crore in the equity market and sold worth | 771 crore in the debt market

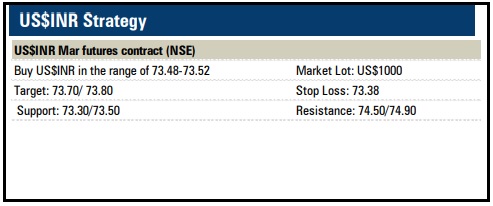

US$INR futures on NSE

* The US$INR March futures fell further as the dollar index started weakening once again while risk currencies exhibited some bounce after a sharp decline was seen on Friday. However, we expect US$INR futures to find support near 73.50 levels in the short-term

* The dollar-rupee March contract on the NSE was at | 73.60 in the last session. The open interest remained almost unchanged in the March as well in April series

US$INR Strategy

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer