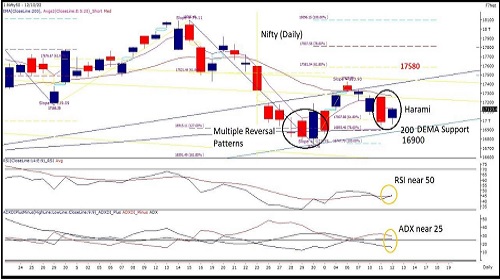

The recent rebound from its 200 DEMA with occurrence of multiple bullish reversal formationskeeps the hope high - Tradebulls Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

Occurrence of a ‘Bullish Harami’ candlestick formation near its past reversal formation junction reiterates the support toremaindependent around 16900-16880 near its 200 dema zone.Its trend strength indicators remain diverging with its RSI nowhoveringnear50zone while ADX is still hovering at 25. The recent rebound from its 200 DEMA with occurrence of multiple bullish reversal formationskeeps the hope high for the ongoing decline to find support again near 16900 zone. Derivative data for todays expiry indicatestheimmediate range at 17000-17300, unwinding within 17250-17300 strikes would be critical for the bullish momentumto unlocktodayitself. While a breach on a closing basis below 17000 would open a fresh lower range extending towards 16600. Banknifty couldremainoscillating within 38800-40000 range itself. With 3 days of consecutive inside bar formations its likely to witness a strong either sidemove during the day. The odds remain in favour of a move towards its upper end with 38500 to retain its support base.Onabroadernote the index is still ambling within a defined range of 17300-16900; longs could be added once a close is reestablishedabove17140(5dema) a with a stop below 16880 while ongoing momentum could see a swing towards 17580 zone once 17300 is breachedwithstrongvolumes which looks unlikely during this week.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...