The index marginally breached Monday’s low (15711) in the initial part of the session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

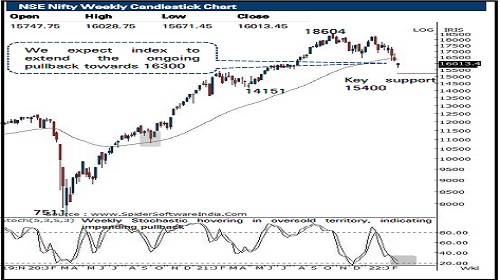

Nifty: 16013

Technical Outlook

* The index marginally breached Monday’s low (15711) in the initial part of the session. However, buying demand emerged at the fag end helping the Nifty to entirely recoup intraday losses and settle above psychological mark of 16000. As a result, the daily price action formed a sizable bull candle that engulfed Monday’s Doji candle, indicating buying demand emerged from oversold conditions

* A decisive close above previous session’s high (15945) signifies pause in downward momentum after recent sharp sell-off of 10% seen over past ten sessions. Going ahead, we expect the index to extend the ongoing pullback towards 16300 in coming sessions. In the process, volatility is expected to remain high ahead of UP election outcome, Fed meeting amid ongoing geopolitical concerns

* On the downside, key support for the Nifty is placed at 15400 which we expect to hold amid ongoing global volatility. Hence dips should be capitalized to build portfolio from medium term perspective by accumulating quality stocks. The key support threshold of 15400 is a confluence of:

* a) 61.8% retracement of CY-21 rally (13596-18604), at 15510

* b) over past two decades, the average correction post breach of 52 weeks EMA has been 5%, which will mature around 15400 in current scenario

* In tandem with benchmark, broader market indices staged a strong pullback from oversold territory. We expect, the Nifty midcap and small cap indices to extend breather in the vicinity of key long term average of 52 weeks EMA in coming weeks

In the coming session, index is likely to open on a on a soft note tracking mixed global cues. As the index has bounced from oversold territory. We expect index to trade with a positive bias while forming a higher high-low. Thus any pullback towards 15920-15955 should be used to create long position for target of 16039

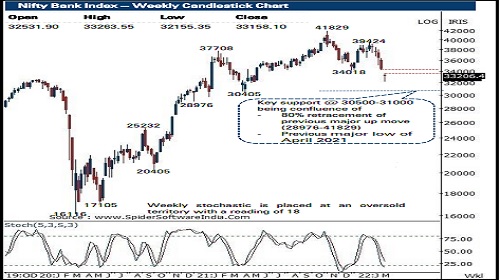

Nifty Bank: 33158

Technical Outlook

* The daily price action formed a bullish piercing line candle as it rebounded taking support around the 32000 levels . A follow through strength and a close above Monday’s gap down area (34094 -33543 ) will signal a meaningful technical pullback in the coming sessions .

* The index after sharp decline of almost 15 % in just two weeks has approached oversold territory with a daily stochastic reading of 17 . Hence, holding above Tuesday low (32155 ) a technical pullback can not be ruled out towards last Friday’s high of 35100 levels which also confluence with the 38 . 2 % retracement of the recent major decline (39424 -32155 )

* The index has key support around 30500 -31000 levels being the confluence of the following :

* (a) 80 % retracement of the previous major rally of December 2020 -October 2021 (28976 -41829 )

* (b) previous major low of April 2021 is also placed at 30405 levels

* Among the oscillators the daily stochastic is seen rebounding from the oversold territory and has generated a buy signal moving above its three periods average thus supports pullback in the index in the coming sessions

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct