The daily price action formed an inside bar as index oscillated within Friday - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

NSE Nifty

Technical Outlook

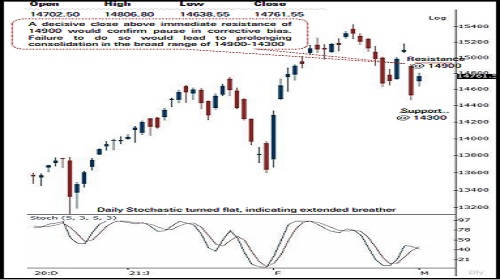

* The daily price action formed an inside bar as index oscillated within Friday’s trading range (14919-14468), indicating pullback after Friday's sharp decline (-3.75%) and attempt to hold the 50% retracement of February rally (13597-15432), at 15514. In the process, Nifty midcap and small cap indices relatively outperformed by gaining 1.8% and 2.1%, respectively

* The index is undergoing a healthy retracement as over the past 10 sessions index has retraced 50% of preceding 11 sessions sharp up move, indicating robust price structure. Therefore, we do not expect the Nifty to breach the key support threshold of 14300. Meanwhile, to confirm the pause in ongoing corrective phase the index needs to form a higher high-low and decisively close above immediate resistance of 14900. Failure to do so would lead to prolonging of ongoing consolidation in the broad range of 14900- 14300 amid stock specific action as we expect relative outperformance of broader market to endure. Hence, buy on dips strategy in quality large cap and midcap stocks should be adopted as the broader structure remains positive

* Our constructive bias on the market is based on following observations:

* a) Since May 2020, the index has not sustained below its 50 days EMA. That subsequently offered a fresh entry opportunity. Currently, the 50 days EMA coincided with rising trend line drawn adjoining April- Sept low (8055-10790) is placed at 14300 b) Price wise, the index has not corrected for more than 8- 9%. In the current scenario, 8% correction from life-time highs would be at 14200 c) Time wise, secondary correction has not lasted for more than a week, since May 2020

* Broader markets maintained their relative outperformance. In the process, Nifty midcap clocked a fresh all time high. In contrast, small cap index is still 15% away from its life-time highs. Thus, catch up activity would be seen in small caps

* In the coming session, index is likely to open on a positive note tracking firm global cues. Follow through strength above Friday's high (14919) would open further pullback option, else continuance of stock specific action amid positive bias. Hence, use intraday dip towards 14765-14790 to create long position for target of 14879

NSE Nifty Daily Candlestick Chart

Bank Nifty

Technical Outlook

* The daily price action formed a high wave candle which remained enclosed inside previous sessions price range signalling lack of follow through to Friday’s sharp decline and buying demand at lower levels

* Going ahead, we believe the current breather should be used as an incremental buying opportunity as we do not expect the index to breach the key support threshold of 34000 . Hence, any dip from here on should not be construed as negative . Instead it should be capitalised on to accumulate quality banking stocks in a staggered manner

* The index over the past 10 sessions has retraced just 38 . 2 % of preceding 13 sessions sharp up move (29688 -37708), at 34645 . The slower pace of retracement signifies healthy retracement that helped weekly stochastic to cool off overbought conditions (currently placed at 70 )

* The key support threshold of 34000 , is the confluence of the following observations : a) The 50 % retracement of the budget rally (30906 -37708 ) placed at 34307 b)The price parity with the previous major correction (32842 - 29688 ) as projected from the recent all time high (37708 ) signals major support around 34000 levels

* On the higher side the index has immediate resistance at 36500 being the confluence of the Friday’s bearish gap area and 61 . 8 % retracement of the of the last weeks decline (37232 -34659 )

* In the coming session, the index is likely to open on a positive note on the back of firm Global cues . volatility would remain high owing to volatile global cues . We expect the index to continue with its previous session pullback . Hence after a positive opening use dips towards 35190 -35260 for creating intraday long position for the target of 35490 , maintain a stoploss at 35090

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct