The benchmark index touched 15000 mark - Choice Broking

Nifty Outlook

* It was a volatile session due to the monthly expiry as after a gap-up opening, the benchmark index touched 15000 mark, but a sudden sell-off has been noticed in the early trades, and nifty slipped more than 200 points from the day high, made a low of 14814.95 levels. Finally, the index has managed to close at 14888.80 levels with a gain of 24.

* Most of the indices like Nifty Auto, IT, FACG showed some correction while Nifty Metal was the market leader with the gain of 5.2% in a day. On the stock front, JSWSTEEL, BAJAJFINSERV, TATASTEEL, BAJAJFINANE were the top gainers which provided a supporting hand to the index while HEROMOTO, HCLTECH, and EICHERMOTORS were the top losers for the day.

* Technically, the Index has given a breakout of its upper band of Falling Wedge formation, which signifies a bull runinthe counter.

* Moreover, the index has given closing above 21- Days Moving Averages.

* At present, the nifty index has a support at 14700 levels while an upside resistance seems at 15050 levels.

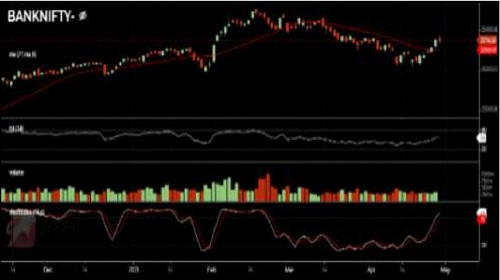

Bank Nifty

* On a daily chart, Bank nifty has settled at 33714.50 levels with a marginal loss of 0.02%. Moreover, the index has given closing above 21&50 Daily moving averages, which suggests strength in the index.

* On a daily chart, Index has formed Doji Candlestick which suggest indecisive nature in the index

* At Present in the Index has support comes at 33000 level while resistance comes at 34500 level

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer