The US dollar declined by 0.41% on Wednesday amid a rise in risk appetite in the global markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

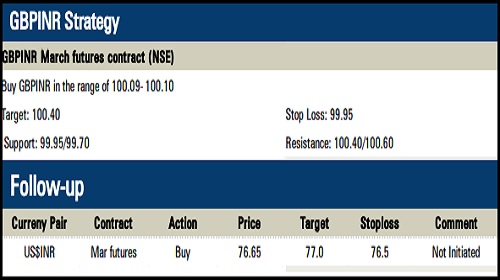

Rupee Outlook and Strategy

The US dollar declined by 0.41% on Wednesday amid a rise in risk appetite in the global markets and on disappointing macroeconomic data from the US. However, US Federal Reserve raised its key benchmark interest rate to 0.50% from 0.25%, first increase in Fed funds rate since 2018 to tame the elevated inflation

Rupee March futures appreciated by 0.49% due to optimistic sentiments in the domestic markets and on softer crude oil prices

The rupee is expected to appreciate today on the back of weakness in the dollar. Additionally, positive sentiments in the global markets may boost the rupee. However, expectations of improved macroeconomic data from the US will continue to support the dollar. US$INR (March) is expected to move towards 75.90 for the day

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory

More News

The USD/INR futures pair has support at 75.70 levels - Monarch Networth Capital