The Nifty settled at 15173, up 67 points or 0.4% - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

NSE (Nifty):15173

Technical Outlook

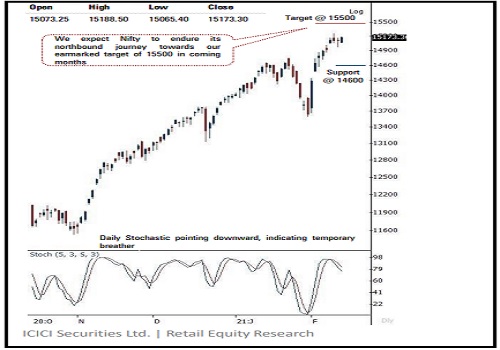

* Equity benchmarks concluded weekly derivative expiry session on a positive note. The Nifty settled at 15173, up 67 points or 0.4%. The market breadth turned positive with A/D ratio of 1.4:1. Sectorally, FMCG, IT, metal outshone while financials and auto took a breather.

* The daily price action formed a bull candle carrying higher high-low, indicating positive bias amid stock specific action as Nifty majorly oscillated within 60 points narrow trading range during the session. In the process, small cap index endured its relative outperformance by gaining 1.8%

* On expected lines, the index has undergone couple of days breather after 12% rally that helped index to cool off the overbought condition (daily stochastic oscillator currently placed at 76) and make market healthy.

* Key point to highlight is that, despite ongoing breather, Nifty has managed to hold the psychological mark of 15000, indicating inherent strength. The resilience in key index heavy weight stocks from telecom, banking and auto space makes us confident to believe that index would resolve higher and gradually head towards our earmarked target of 15500 in coming month as it is 161.8% external retracement of past two week’s fall (14754-13596), at 15466

* We expect broader market to accelerate its relative outperformance against benchmark, wherein small caps would witness catch up activity. Globally, broader market indices have been relatively outperforming their benchmarks, and trading near all time highs. The Nifty midcap index has also maintained its positive correlation with its global peers and currently trading at life highs. However, the broader market counterpart, Nifty small cap index is still 18% away from its life highs. Thus, we expect small caps to witness catch up activity within broader market space

* Structurally, we believe the Nifty has strong support at 14600, which we do not expect it to breach. Hence, any temporary breather from here on should be capitalised to accumulate quality stocks, as key support of 14600 is confluence of 38.2% retracement of current up move (13597-15257), placed at 14622 coincided with earlier consolidation breakout area around 14650 In the coming session, we expect the index to witness follow through strength to Thursday’s up move and maintain a higher high-low formation, which would confirm the continuation of upward momentum. Hence, use intraday dip towards 15090-15114 to create fresh long position for the target of 15198.

NSE Nifty Daily Candlestick Chart

Bank Nifty: 35752

Technical Outlook

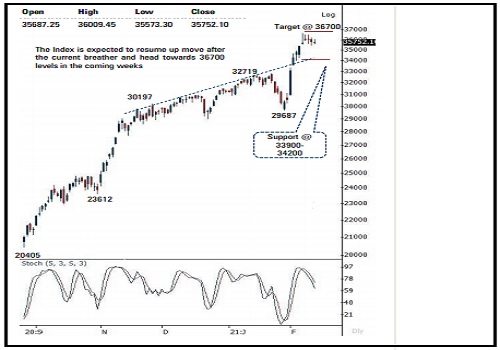

* The Nifty Bank index traded in a narrow range to settle the expiry session on a muted note . The index traded choppy for entire session before closing at 35752 down by 31 points or 0.09% Technical Outlook

* The daily price action remained enclosed within Wednesdays trading range as index extended its breather after a gain of more than 23% in the preceding week. The low of Wednesday session is placed at the last Friday’s bullish gap area (35344 -35545 ) sustaining above the same will lead to a pullback in the coming sessions . Failure to do so will lead to an extended correction

* Key point to highlight is that after a rally of 6900 points in just seven sessions the daily stochastic had approached to overbought trajectory which has resulted in a sideways consolidation in the last four sessions . With this backdrop, current breather should not be seen as negative instead one should adopt buy on decline strategy as the overall structure remain firmly positive for up move towards 36700 levels as it is the 123 . 6 % external retracement of entire CY20 decline (32613 -16116 )

* The short term support for the index is placed around 34200 - 33900 levels as it is the confluence of the following : a) 38 . 2 % retracement of the current up move 29687 to 36615 is placed around 33968 levels b) Value of a bullish gap post Budget day at 33583 levels c) The value of the rising trendline joining recent high since November 2020 is also placed around 34200 levels

* In the coming session, the index is likely to open on a flat note tracking mixed global cues . We expect index to trade with a positive bias while holding above Thursday’s low (35573 ) . Hence , after a soft opening we recommend to utilize intra day dips towards 35700 -35745 for creating fresh long positions in Bank Nifty February Futures for target of 35882 meanwhile stop loss is placed at 35638

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Nifty opened with an upward gap and remained lackluster within narrow trading range througho...