The Nifty midcap and small cap indices relatively outperformed the benchmark - ICICI Direct

NSE (Nifty): 14684

Technical Outlook

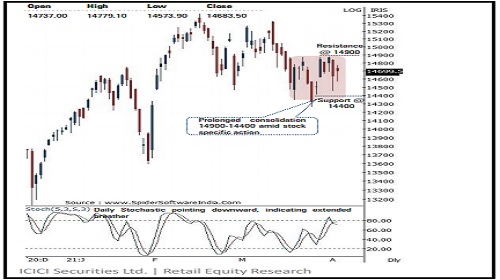

* Equity benchmarks concluded Tuesday’s volatile session on a positive note as the Nifty was up 46 points or 0.3% to settle at 14684. Sectorally, pharma, FMCG and metals outperformed. Meanwhile, financials remained subdued ahead of the RBI policy outcome that is due on Wednesday.

* The daily price action formed an inside bar as the index oscillated within Monday’s broad trading range (14850-14460), indicating extended breather amid stock specific action. In the process, broader markets outperformed on expected lines

* The lack of faster retracement on either side signifies prolonged consolidation, which makes us believe the index would extend its ongoing consolidation in the broad range of 14900-14400 amid stock specific action. Key point to highlight over past twelve sessions is that declines are getting more time consuming and shallower in nature.

* Meanwhile, rotational sectoral leadership remained in focus, indicating broader market participation. Hence, buying quality large cap and midcap stocks ahead of the upcoming Q4FY21 result season would be the prudent strategy to adopt from a medium term perspective

* The Nifty midcap and small cap indices relatively outperformed the benchmark as they gained ~1%, each compared to Nifty, up 0.3%. Currently, global broader market indices are approaching their lifetime highs. We expect domestic midcaps to maintain the positive correlation with its global peers and maintain their relative outperformance, going ahead. The broader market indices are showing resilience by sustaining well above their last week’s low, highlighting elevated buying demand that augurs well for subsequent up move

* Structurally, rallies have started getting elongated whereas corrections have been shallower, leading to truncated price action. Hence, we believe the Nifty has been forming a strong support base in the vicinity of 14400 as it is 61.8% retracement of post Budget rally (13662-15432), at 14338 In the coming session, index is likely to open on a flat note amid mixed global cues. We expect index to extend the ongoing consolidation with a stock specific action.

* Over past two sessions, index has been forming long lower shadows, displaying elevated buying demand. Hence use intraday dip towards 14650-14673 for creating long position for the target of 14764

NSE Nifty Daily Candlestick Chart

Nifty Bank: 32501

Technical Outlook

* The Nifty Bank index declined for the second consecutive session down by 0 . 5 % on Tuesday ahead of the RBI monetary policy outcome on Wednesday . The decline was mainly lead by the private banking stocks while PSU banking stocks closed on a flat note . The Nifty Bank closed the session at 32501 levels down by 177 points or 0 . 5 %

* The daily price action formed a small bear candle which remained inside previous session range highlighting range bound trade with corrective bias . The index is seen consolidation at the major breakout area around the yearly high of CY 2019 & CY 2020 placed around 32500 levels

* Going ahead , the index sustaining above Monday’s low (32330 ) on closing basis will keep pullback option open and will lead to a pullback towards 34000 levels in the coming sessions. Failure to do so will lead to an extended correction

* The support for the index is currently placed at 32600 -32300 levels being the confluence of the following technical observations : a) 61 . 8 % retracement of the previous rally (29687 -37708 ) placed at 32750 levels b) Major breakout area of previous multiple yearly highs placed around 32500 levels c)The rising 100 days SMA is also placed at 32464 levels

* The index has immediate hurdle at 34000 levels as it is the confluence of the previous week high and 50 % retracement of the last leg of decline (36497 -32330 ) .

* The last seven weeks corrective decline has lead to the weekly stochastic placed near the oversold territory with a reading of 19 indicating an impending pullback in the coming weeks . However, the index require to start forming higher high -low in the daily chart on a sustained basis and close above the immediate hurdle of 34000 to signal a resumption of up move

* In the coming session, the index is likely to open on a flat note on back of muted global cues . Volatility is likely to remain high on account of the RBI monetary policy outcome . We expect the index to hold above last two sessions almost identical lows (32413). Hence use dips towards 32410-32480 for creating long position for the target of 32690 , maintain a stoploss of 32290

Nifty Bank Index – weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer