The Nifty index opened on a flat note and gradually moved higher during the day - Angel Broking

Sensex (49792) / Nifty (14645)

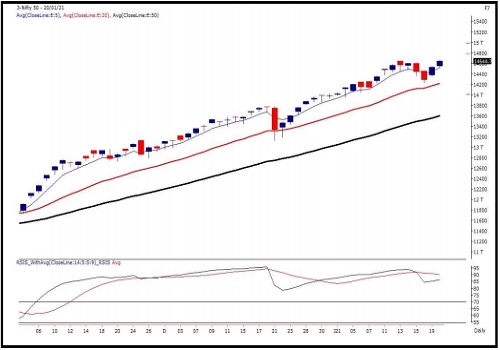

The Nifty index opened on a flat note and gradually moved higher during the day to register new highs. In just a couple of sessions, the index recovered all its losses of the recent correction and has ended the day tad below 14650. The index continued its previous day’s upmove yesterday supported mainly by the IT heavyweights. The Auto stocks and the heavyweight Reliance Industries too contributed and participated in the upmove.

Although, the Banking index consolidated in a range yesterday and relatively underperformed the Nifty as no significant momentum was seen in the private sector banking stocks. If we look at the recent chart of Nifty on the daily time-frame, it is seen that the 20-day EMA has acted as a support on intermediate declines and the index has continued its ‘Higher Top Higher Bottom’ structure. With last two days of upmove, this moving average support now coincides with Monday’s low of 14222 and thus, it now becomes a sacrosanct for the short term.

Apart from this, the Nifty Midcap index had seen some correction from its important level as per the retracement theory and hence, it would be crucial to see if this index surpasses its swing high with an ease. In case the midcap index does not break this hurdle, then we could see some volatility again in the short term and hence, traders should keep a close tab on this index.

Meanwhile, we continue with our advice for traders to keep focusing on stock specific moves and identify the sectors which are showing momentum on a given day. Traders should also avoid taking leverage positions at this juncture and focus on timely exits on the trading positions. The intraday supports in Nifty for the coming session are placed around 14535 and 14490 whereas resistances are seen around 14710 and 14770.

Nifty Daily Chart

Nifty Bank Outlook - (32544)

The banking index too opened flat along with the benchmark index. However as the day progressed, we witnessed good buying momentum in Nifty; courtesy to some of the heavyweights like, RIL, HDFC, IT and Auto counters. The BANKNIFTY too extended its gains a bit; but relatively it underperformed the benchmark index.

For the major part of the day, BANKNIFTY remained in a consolidation mode to add nearly four tenths of a percent gains. Monday’s corrective move has completely been engulfed and markets are trading in a positive territory for the week. Yes, the sentiments across the globe continues to be optimistic and no negative development is as good as a positive trigger for the market. Hence, we are seeing good buying momentum in last couple of days.

However, for BANKNIFTY 32700-33000 remains to be a strong resistance and till the time it’s not crossed, 32700 – 32000 remains to be an immediate range. Let see how things pan out on the penultimate weekly expiry day. Traders are advised not to get carried away and should stay light on positions.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on Market Wrap Up 24th July 2025 by Shrikant Chouhan, Head Equity Research, Kotak Secu...