The Nifty continued to trade higher and gained another 1.5% last week without any major participation from index heavyweights - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Support placed near 15400 in current uptrend…

* The Nifty continued to trade higher and gained another 1.5% last week without any major participation from index heavyweights. Broader markets continued to perform better and both midcap, small cap indices registered gains of almost 2.5% each last week. Going ahead, we expect some consolidation in the index with support near 15300 in the coming week

* We believe that participation from index heavyweights will be crucial for continuance of the up move. While heavyweights from banking and technology space are hovering near their highest Call bases, further consolidation cannot be ruled out. In such a scenario, one should create long positions on any profit booking. We expect 15400 to act as immediate support for the index

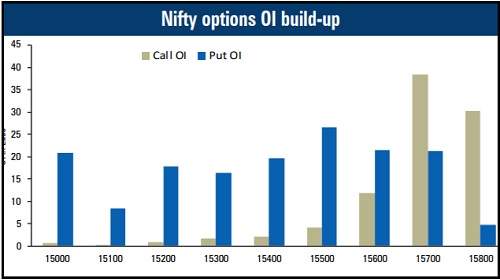

* On the options front, the highest Call option concentration is at ATM 15700 Call strike with almost 42 lakh shares, which is the highest OI base among Call and Put strikes. Among Put strikes, the highest Put base is placed at the 15500 strike. On the index futures front, net short positions from FIIs are one of the lowest ever and some short accumulation should be seen at higher levels. This may keep upsides restricted for the Nifty in short-term

* The volatility index has moved to its lowest levels since February 2020 and trading near 16 levels. Such low levels also suggest some caution in the market and a rise in volatility cannot be ruled out, which may result in the Nifty moving towards 15500 in short-term

Bank Nifty: Major Call OI in ATM strikes suggest consolidation

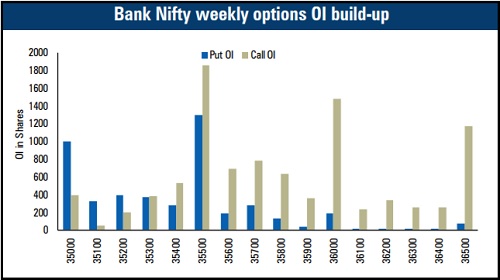

* Major indices started the June series with higher OI base at ATM strikes. Even though supportive buying was seen there is no closure in ATM strike Calls

* For the week, banking stocks remained almost flat with stock specific activity. Last week we saw addition in 35500 strike straddle. On the back of that the index ended almost flat

* However, Call writing activity remained higher in ATM and OTM strike Calls. Major Call OI base for the week is well distributed from 35500 to 36500 strikes whereas again this week combined OI is higher in ATM strike Straddle of 35500, which is likely to keep index move in range

* Among private leaders, we feel HDFC Bank and Axis Bank are likely to consolidate whereas supportive action could be possible from Kotak Mahindra Bank. Looking at the declining IVs and buying by FIIs in the cash segment we feel a move towards 34500 levels would be a buying opportunity

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct