The Acceleration of a Digital Boom - Weekly article by Ms. Nirali Shah, Samco Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Quote on The Acceleration of a Digital Boom - Weekly article by Ms. Nirali Shah, Head of Equity Research, Samco Securities

Indian markets touched life time highs on Friday as the bulls reclaimed their stance pushing indices higher. And rightly so India VIX is currently at 17 while it had touched highs of 86 when COVID-19 hit shores. A lot has changed over the past year! 2020 was best labelled “THE YEAR OF UNKNOWN” with uncertainty across transmission rate, possibility of vaccine, impact on economy etc., but this time the preparedness is much better than last year. The start of 2020 was all about technology and PSU growth, US saw the emergence of SPACs, followed by the wide acceptance of cryptocurrencies globally along with record-high commodity prices but now we are witnessing some of that cooling down. Corporates had undergone cost cutting measures the last year in order to safeguard their margins but this time they are witnessing a rise in raw material, input costs, packaging costs along with higher fuel and freight costs but even then the demand could keep margins balanced going forward. India attracted over $80Bn in FDI in FY21 which is the highest ever and the coming months could also continue to see inflows provided the Fed and central banks continue to inject liquidity into the system. In all likelihood, this could be a year of unwinding. In all likelihood, this could be a year which will fully manifest all of these measures undertaken by both financial and non-financial institutions to contain the pandemic.

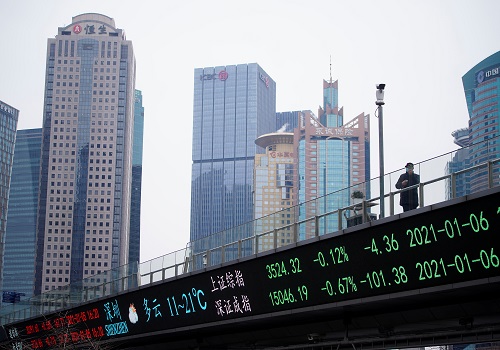

Just as the Industrial Revolution, the years ahead of us could witness a Digital Revolution. The theme that has attracted the most traction in the past year is technology and digitization. Be it supply chains, robo-advisory, e-commerce sales or fintech, digitization has been central to all such developments. But this is just the beginning and automation will pave the way for the future as companies are undergoing massive structural changes which make them ideal secular bets for the long term. Nifty will face hiccups on the way but the longer bull rally is here to stay as the digital, infra, consumption and real estate boom will continue undeterred. A sustenance of this boom will drive Indian markets from a $3Tn Mcap to the next level in line with the developed nations such as China at $11.4Tn market cap and the US at $47Tn Mcap. The secular story is intact but in near term the excesses in valuation need to get corrected for a healthy next leg up.

Event of the Week

Fuel prices especially petrol breached the coveted Rs. 100/litre mark. This follows a 14-day streak as OMCs kept revising fuel prices upwards across India. The hikes are mostly in-line with the gradual rise in global oil prices as Brent Crude prices touched $70/bbl. Support from US economy and employment data diffused concerns around the impact of the rise in Iranian oil supply, which had earlier prevented oil prices from moving upwards. Overall global bullishness and demand are keeping oil prices at current levels. But investors need to be cautious as the OPEC meeting slated for June 1 will dictate the supply, production and price indications going ahead.

Technical Outlook

Nifty50 index crossed lifetime highs and closed the week on a positive note. However, this week’s upmove was slow and lacked strength. It is likely the benchmark index could face resistance at higher levels. The bulls are getting tired as the index is trading much higher than its mean levels. Hence, a brief corrective dip cannot be ruled out. 15,160 is the immediate support level for Nifty.

Expectations for the Week

Developments surrounding inflation continue to be on everyone’s watch. The opening up of our economy will have a hold over how the demand shapes up. The true picture of the damage by the second wave will only be visible in the June quarter results but until then management commentaries will continue to guide the Street. With no concrete triggers in place yet, markets continue to look for a strong reason to advance towards the unknown atleast in the near-term. Therefore, investors should seek selective bets, and wait for corrective moves before investing for long term. Nifty50 closed the week at 15435.7, up by 1.7%.

Above views are of the author and not of the website kindly read disclaimer

.jpg)

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...