Sustainability above 13800 may trigger fresh uptrend for Nifty By ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Sustainability above 13800 may trigger fresh uptrend for Nifty…

* The Nifty witnessed a subdued settlement as continued declines were seen last week and it lost almost 1000 points from the highs. Further, FIIs turned negative in the last few session, which caused extended selling pressure. However, despite this, FIIs have bought more than | 23000 crore in January till now

* The open interest in the Nifty has declined compared to the last month at inception. The February series is starting with open interest close to 9.6 million against 11.8 million shares seen in the last series. However, the roll spread has come under pressure as expected and Nifty February futures closed with just 30 points premium indicating some liquidation ahead of the Budget

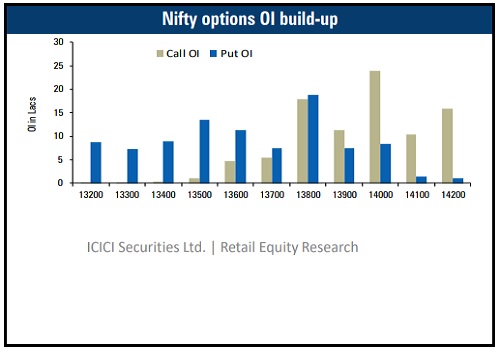

* Ahead of the Union Budget, no major option concentration is visible in either Call or Put strikes. However, Put base for the February series is placed at ITM 14000 strike followed by 13500 strike. On the higher side, immediate Call concentration can be seen at 14500 strike for the monthly expiry. Moreover, volatility has remained elevated near 24 levels throughout the week as selling pressure was experienced in emerging markets

* Most index heavyweights have seen relatively low rollover as closure of positions were seen across the board. We believe fresh leverage positions will be formed post Budget which provides a further directional move. However, select auto and pharma stocks are witnessing continued short additions

Support at 29000 in volatile session due to Union Budget…

* The Bank Nifty relatively outperformed the Nifty as both indices fell almost 1000 points for the week. Post the quarterly numbers of Axis Bank, the stock managed to gain 4% but a sharp recovery was seen from | 1350 levels in HDFC Bank, which largely remained muted last week. Among PSU banks, Bank of Baroda saw aggressive profit booking post its quarterly numbers

* After initial spike in Volatility index – VIX towards 25.5 levels, no major spike was observed as it remained near 25 levels even thought the Nifty fell by another 500 points. The Bank Nifty started the current month with relatively high OI base suggesting some short additions ahead of event

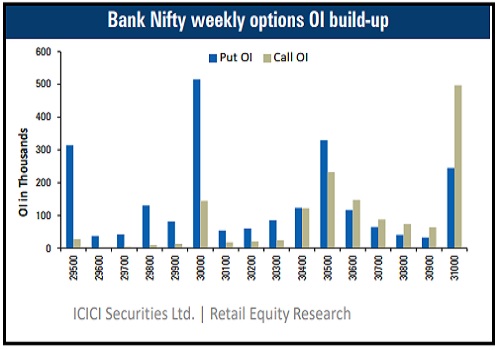

* Intraday short covering last Friday helped the index to test its weekly highest Call base. We feel a close above 31000 would open the gates for higher targets. For the main expiry, Call OI addition are visible in 32000 strike followed by 32000 whereas major Put OI concentration is placed at 29000 strike, which remains the strong support area

* Overall bias for the Bank Nifty remains positive due to no major Call writing blocks, lower leverage positions and Put writing in private banks OTM strike. If Union Budget 2021 does not disappoint, than fresh buying interest could emerge in Bank Nifty and it could move towards its sizeable Call base of 32000

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

India's Oct merchandise exports grow 43.05% y/y - trade ministry

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct