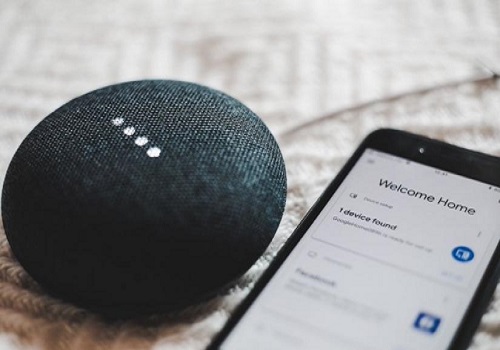

Smart home devices market declines further, slump to last into 2024

The global shipments of smart home devices fell 5.6 per cent (year-over-year) to 186 million units in the first quarter (Q1) this year.

Smart speakers and networked video entertainment devices faced the steepest declines in the first quarter, down 15.4 per cent and 7.8 per cent,

respectively, compared to the prior year, according to the International Data Corporation (IDC).

The overall market is likely to decline by 1.8 per cent in 2023 as weak consumer demand and economic volatility continue to put significant downward pressure on the market.

"While there have been pockets of growth, the market has largely stalled due to lack of meaningful upgrades between one generation of devices and

the next," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers.

"Even the launch of the Matter standard has not been enough to spur demand despite offering some ease of use,” he added.

Matter is a global smart home standard that was launched in November 2022. It is maintained by the Connectivity Standards Alliance.

Although much uncertainty exists, IDC expects the market will return to growth in 2024 and continue through 2027 with device volumes reaching 1.1

billion shipments in 2027.

Apart from smart speakers and networked video entertainment devices, many other smart home categories such as lighting, thermostats, and home

monitoring and security devices are expected to witness high growth over the next five years in part due to rising consumer awareness of smart home

devices in many parts of the world and the rise of emerging markets, said the report.

"The worldwide smart home market is witnessing uneven growth as some regions fare better than others," said Adam Wright, research manager, Smart

Home and Office Devices at IDC.

In more mature markets like the US, high installed bases of devices coupled with issues of underutilisation, ongoing disruptions form supply chains,

logistics issues, high inflation, and record high credit card debt have impacted the market's growth in 2022 and the first part of 2023.

“But other regions that are earlier in their adoption curve like Latin America and parts of Asia/Pacific have much opportunity for growth,” said

Wright.