Rupee remains Calm among Volatile Asian Peers - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee remains Calm among Volatile Asian Peers - HDFC Securities

● The Indian rupee marked a seventh weekly loss in its last eight tries, all because of the hawkish central banks. Haven buying remains intact towards the US dollar on descending risk sentiments continue. Spot USDINR gained 0.3% to 78.08, last week. This week may be calmer with old factors of crude and foreign funds that will drive the forex market. Technically, the pair is having resistance at 78.40 and support at 77.70.

● Last week ended with the shock revelation that inflation hadn’t peaked. The months after the Lehman bankruptcy, the aftermath of 9/11 and the dot-com crash, Black Monday, the pandemic panic of March 2020, and the Oil Shock -- there haven’t been many events since the end of WWII as disastrous for stocks as the past two weeks.

● India’s foreign exchange reserves declined $4.6 billion to $596 billion for the week ended June 10, the RBI data showed. The fall in total reserves was mainly because of a decline in foreign currency assets worth $4.5 billion which is on the back of revaluation and intervention.

● Worldwide, 33 rate-setting central banks have raised borrowing costs in the past month. The Federal Reserve is now the most aggressive in the G-10 year-to-date, a fact that justifies the dollar’s strength and will help sustain it.

● Japanese Yen chocked its biggest drop against the dollar since March 2020 after the BoJ kept policy on hold, defying pressure to follow its global peers and move towards tightening.

● On Global FX positioning, traders aggressively sold the euro (56.6k), flipping from long to slightly short. Given the size of the euro flow in particular, however, the aggregate dollar long rose by a little over $2 billion on the week.

USDINR

Technical Observations:

● USDINR futures gained for the seventh week in a row, the first time since July 2019.

● The pair has been facing stiff resistance around 78.40, the upward sloping channel’s resistance and the upper band of the Bollinger band.

● The pair is having support at 77.86, the middle band of the Bollinger band.

● Momentum oscillators, Relative Strength Index of 14 days exited from overbought zone and given negative cross over indicating weaker momentum.

● The bias remains bullish as long as USDINR June futures trades above 77.70 while on the higher side 78.40 will remain a challenging level to cross.

EURINR

Technical Observations:

● EURINR June futures formed reversed after falling below the lower band of the Bollinger Band on Friday. However, the sentiment remains weak as it needs to cross the middle band of the Bollinger band for reversal.

● The pair is having resistance at 82.95, the 21 Days exponential moving average.

● Looking at the chart pattern, the pair is likely in the formation of head and shoulder patterns with neckline support at 81.40. The right shoulder could be formed around 83.

● Momentum oscillator, Relative Strength Index of 14 days given positive crossover but still remained below 50.

● EURINR June futures is expected to show short-covering bounce incoming days but the trend remains down as long as it trades below 83.30.

GBPINR Technical

Observations:

● GBPINR June futures formed a Doji candlestick pattern on Friday after the gap-up opening. The pair is having resistance at the middle band of the Bollinger i.e. 97.

● The pair is trading in falling fan with the resistance at 96.50 and 97.80 while support has been placed around 94. The directional trend remains bearish as long as it trades below 98.50.

● Momentum oscillator, RSI has given positive cross over to average but remains below 50, indicating weaker momentum.

● GBPINR June futures could show a shortcovering bounce in the coming days but the trend remains bearish and the bounce will be used to make a fresh short sell with a stop loss of 98.50 and a target of 94.

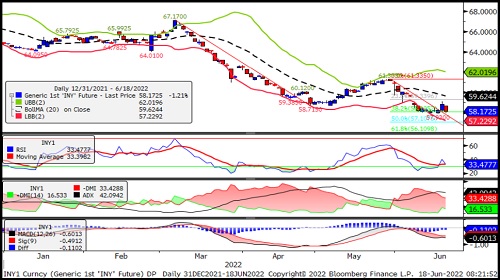

JPYINR

Technical Observations:

● JPYINR June futures closed near the recent bottom. The pair has been trading in a bearish sequence of lower top lower bottom on major time frames indicating the continuation of a bearish trend.

● The pair is having support between 57.10 to 57.20, the 50% Fibonacci extension and the lower band of the Bollinger band.

● Momentum oscillator, Relative strength index of 14 days currently placed at 34 again started weakening indicating negative momentum.

● Short selling has been seen in the week gone with a fall in price and a rise in open interest and volumes.

● JPYINR June futures is expected to trade lower once the level of 57.90 breaks while on the higher side it has resistance at 59.62, the middle band of the Bollinger band.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory