Rupee likely to open up as crude oil retreats - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rupee likely to open up as crude oil retreats - HDFC Securities

Rupee expected to open flat and take cues from the risk assets and crude oil. Overnight weakness in dollar index and crude oil price, along with rebound in risk sentiments could help rupee to open slightly higher. On Thursday, spot USDINR gained 7 paise or one tenth percentage to 76.37, up to the forth days in row. The pair has been consolidating in the range of 76.60 to 76 since last six days. We might see resilience around 76.50 in today’s session on back of profit booking

Stocks in Asia were steady Friday as investors weighed the resilience of the global economic recovery to risks from tightening Federal Reserve monetary policy and Russia’s military campaign in Ukraine

The yen fell for a fifth day as U.S shares and bond yields rose. Commoditysensitive currencies gained even as oil slipped. Oil fell as major countries address supply issues and after EU leaders agree to modest tightening of Russia sanctions. The selloff in Treasuries and bonds globally continued, with the yield on the benchmark US 10-year note rising 5bps to 2.34%.

The S&P US manufacturing PMI for February and US weekly jobless claims beat estimates, though February US durable goods missed. The first-time jobless claims released Thursday totaled 187,000 last week — the lowest level since 1969

In the news, Biden called for Russia’s removal from the G-20; Europe rejected Putin’s demand for natural gas payments in rubles; and NATO called on China not to send military aid to Russia.

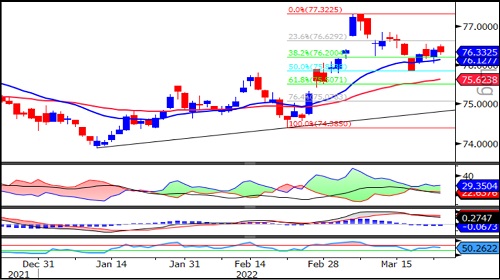

USDINR

Technical Observations:

USDINR March futures has been consolidating in the range of 75.85 to 76.60 range since last six days.

The pair has been holding support of short term moving average 21 days.

It has been holding bullish sequence of higher highs and lows on daily chart

Relative Strength Index of 14 days period oscillating around 50 indicating consolidation in near term.

The option derivative data indicating highest open interest at 76 strike while call writing has been seen on 76.50 CE. Indicating current month settling between 76 to 76.50.

USDINR March futures bias remains bullish as long as it holds 76 while on higher side resistance placed at 76.60.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

EURINR trading range for the day is 89.13 - 89.49. - Kedia Advisory