Rupee future maturing on August 26 depreciated by 0.18% on Thursday amid steep rise in crude oil prices - ICICI Direct

Rupee Outlook and Strategy

* The US dollar edged higher by 0.78% on Thursday as Federal Reserve officials spoke of the need for further rate hikes and strong economic data from the US. The number of Americans filing new claims for unemployment benefit fell to 250,000 for the week ended August 13, well below expectations of 265,000. Additionally, the Philadelphia Fed manufacturing index in the US rose to 6.2 in August of 2022 from -12.3 in July, returning to positive territory after two consecutive negative readings and above market expectations of -5

* Rupee future maturing on August 26 depreciated by 0.18% on Thursday amid steep rise in crude oil prices

* The rupee is expected to depreciate today amid a rise in crude oil prices. Further, investors will closely watch forex reserves data from India for more clarity. US$INR (August) is likely to trade in a range of 79.60-79.80

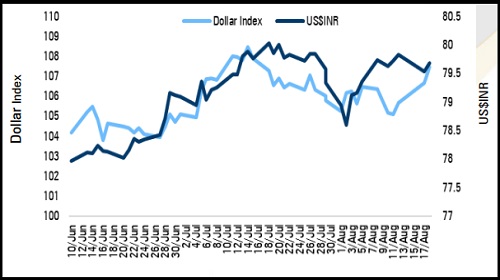

Dollar Index vs US$INR

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer