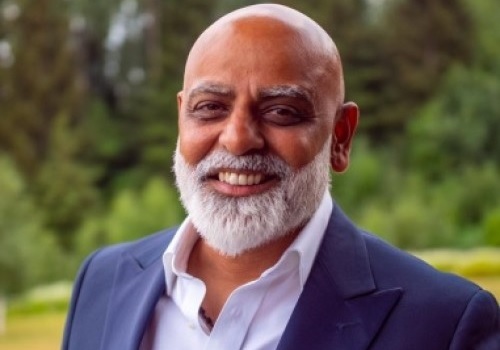

RBI`s commentary on growth has been positive while that on inflation has been pointing towards moderation Says Siddarth Bhamre, Religare Broking Ltd.

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below View On RBI Monetary policy by Siddarth Bhamre, Research Head, Religare Broking Ltd

RBI’s commentary on growth has been positive while that on inflation has been pointing towards moderation. It’s the global uncertainties and inflation still remaining above the upper band of the targeted range which led to MPC continuing its stance of withdrawal of accommodation and increasing repo rates by 35 bps to 6.25%. The calibrated monetary policy action is warranted to keep inflation expectations anchored, break core inflation persistence and contain second round effects.

Growth rate projection of 6.8% was supported by firmness in urban consumption and pickup in rural demand. PMI data for the manufacturing and services sector also pointed towards an increase in economic activity. However, the stickiness of core inflation has ensured that RBI continues its battle against inflation in order to stabilize prices for sustainable growth.

India remains the fastest growing economy despite IMF projection that more than one-third of the global economy will contract this year or next year. We believe this hike in interest rate won’t derail the Indian economy and price stability would only aid our economic growth.

Just like the worst of inflation is behind us comment by RBI, falling commodity prices especially that of crude, FED's commentary and moderating inflation suggests that the quantum of hike, if at all there is a hike in near future will be much lesser than what we have seen since June 2022.

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Perspective on RBI Monetary Policy by Ms. Shweta Thakker, AhujaHIVE