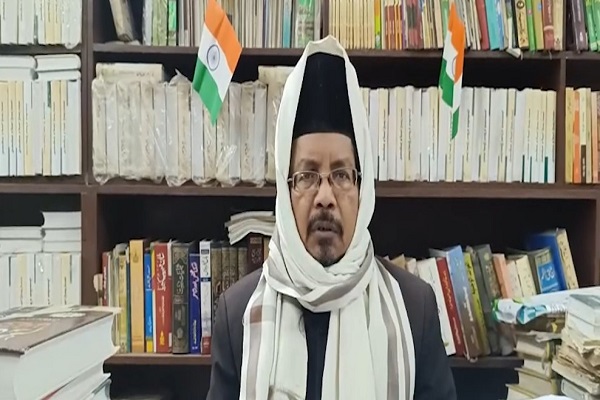

RBI MPC announcement By Alok Jain, Weekend Investing

Below View On RBI MPC announcement By Alok Jain, smallcase manager & Founder, Weekend Investing

“The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) in its second bi-monthly monetary policy meeting of FY24 decided to leave the repo rate unchanged at 6.5%. The MPC voted 5 members to 1 to remain focused on withdrawal of accommodation. The RBI also retained FY24 GDP growth forecast at 6.5%, while expects FY24 CPI inflation to be at 5.1%. As expected the RBI has not tinkered with the repo rate given that inflation has well been under control and the cues from overseas also signal that some more pause may be exercised by the Fed. A heartening note of the RBI minutes was the disclosure that more than 50% of the 2000 notes in circulation end of Mar 23 have come back within 2 weeks of the exercise and most of them have come in as deposits. This if stays in the system will give a huge liquidity boost of nearly 3 lac crores if 80-85 pct stays in. This has the potential to work like a mini stimulus and boost the economy while fighting the move for higher yields due to the tightness in liquidity.”

“Over all I am happy that the RBI is treading cautiously in its monetary policy and not jumping the gun in giving clues about cutting of rates down the line. The FED policy remains a mystery and with several central banks still raising who knows if we may still have to fight the inflation monster again few quarters down the road.”

Above views are of the author and not of the website kindly read disclaimer